Leveraging B2B Outbound Prospecting To Accelerate Organic Growth (Part 3 of 3)

B2B companies with a compelling value proposition operating in markets that have from a few thousands to a few hundred thousands potential customers should embrace account-based outbound prospecting to accelerate organic growth. In previous articles, we discussed what is outbound prospecting and why it's important and how to develop an investment case for an outbound prospecting program. Here we illustrate how to setup and launch an account-based outbound prospecting pilot program in about 12 to 16 weeks referencing a case study from the flexible packaging industry.

How to setup and launch outbound prospecting

B2B companies that have decided to embrace outbound prospecting to accelerate new customer acquisition can setup and launch new processes and campaigns in 8 to 12 weeks and start collecting preliminary data regarding their ability to engage new prospect accounts in the following 4 to 5 weeks.

During the initial 4 to 5 weeks after launch, Sales Development Reps (SDRs) will reach out to an initial group of prospects to start testing the new processes and campaigns (in our case study, about 600 prospect contacts working in key positions at about 100 prospect accounts). Engaging at least 5% to 8% of the targeted prospect accounts will usually be considered a successful start.

Given the typical length of B2B sales cycles and qualification periods, generating the first new sales opportunities will usually take at least an additional 2 to 3 months. After that period, if successful the program will start generating the first new sales opportunities accepted by Account Executives (AEs). The exact number will depend from the volume of targeted prospect accounts, the conversion rate metrics, and the average time taken by engagement and qualification activities.

In our flexible packaging case study, given that we planned to reach out to about 200 prospect accounts during the first two months after launch and that the average time for engagement and qualification activities (∆T1 + ∆T2 + ∆T3) was estimated to be about 3 months, based on targeted conversion rate metrics the program was expected to generate between 3 and 5 new sales opportunities withing 5 months from launch.

Finally, to see the first sales opportunities convert into actual sales will usually take an additional 3 to 4 months and in some cases a bit longer. If successful, at this point the program will start generating the first new sales and have a few additional sales opportunities in advanced negotiation in the pipeline. This is why a 12-month period is the minimum required time for B2B companies with a relatively long selling cycle to validate the effectiveness of an outbound prospecting program.

In our case study, by the end of the 12-month period if successful the program would generate 2 to 4 sales contracts with new accounts and have a few additional sales opportunities in advanced negotiations.

During the initial 12-month period, a successful outbound prospecting program will generate initial levels of interest and engagement, some new sales opportunities, and some new actual sales. The actual measures of its success, however, will be the creation of a repeatable and scalable data driven and intelligently automated sales process and the generation of ongoing improvements in key sales metrics through continuos optimizations.

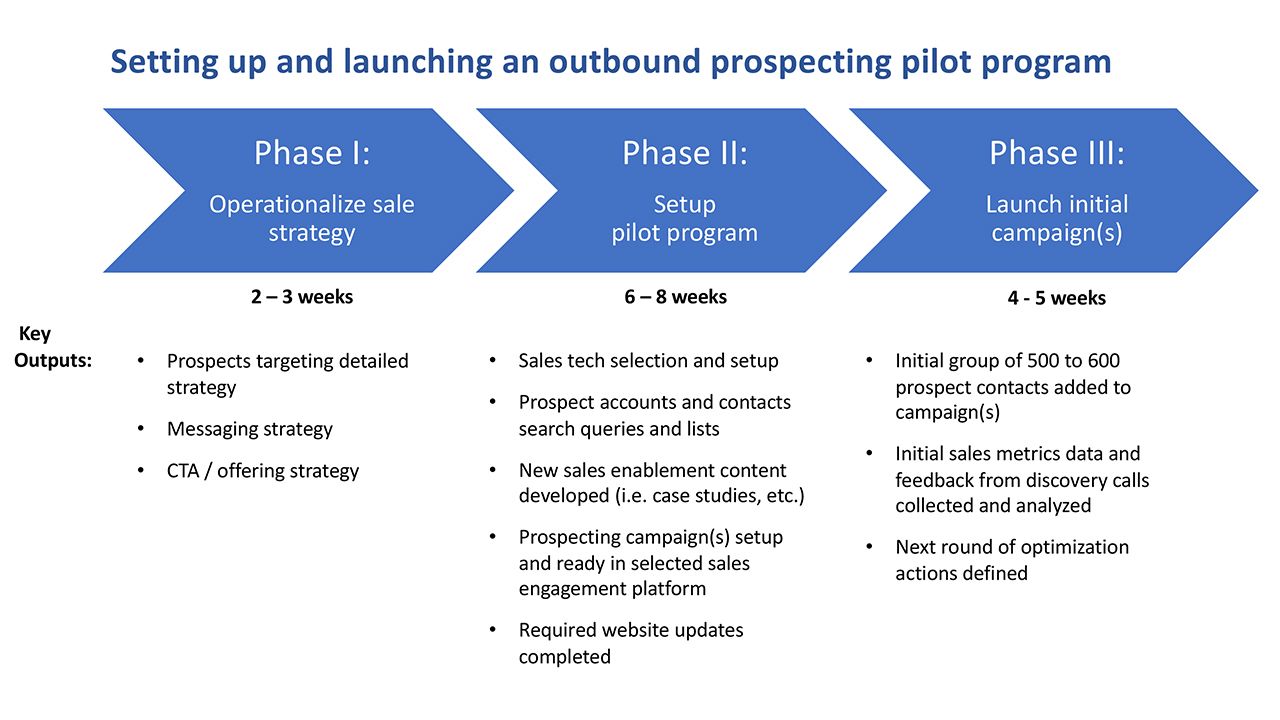

The work required to setup and launch an outbound prospecting pilot program can usually be done in about 12 to 16 weeks and is best organized in three phases with the following objectives:

- Phase I: Operationalize sale strategy.

- Phase II: Setup pilot program.

- Phase III: Launch initial campaign(s).

The chart below illustrates the typical duration and key outputs for each phase.

In the following sections we'll discuss in more details the main activities and key outputs of each phase.

Phase I: Operationalize sales strategy

The objective of Phase I is to develop a set of detailed strategic guidelines that will allow the Sales Development Team to properly setup the outbound prospecting program in Phase II. These guidelines are developed through a series of one-to-one interviews and some group brainstorming sessions with the CEO, senior leaders from the sales and marketing organisations, and a selected group of sales and marketing executives and managers.

Often, involving executives from Operations and Customer Service will also prove extremely valuable to surface good examples of how the company has been creating value and impact for current customers (i.e. ideas for case studies).

The key topics addressed during this phase are:

- The ideal customer profiles and personas for prospect accounts and contacts and guidelines on the optimal contact strategy (i.e. how many prospects to contact each week, which accounts to prioritize, etc.).

- Suggestions, based on past experience, about proven messaging strategies to generate interest and engagement among prospects and to effectively differentiate the company's unique abilities relative to its competitors (i.e. main customers' pain point to focus on, case studies to be used to prove impact, testimonials to be used to increase credibility, etc.).

- The call to action (CTA) and offering strategy to be used to generate engagement and new sales (i.e. discovery meetings with product or solution experts, samples, facility tours, product categories to focus on, special pricing and promotions for first time customers, etc.).

The table below illustrate an example of prospect accounts' ideal customer profiles and a do not contact list from our flexible packaging case study.

| SEGMENT | DESCRIPTION |

|---|---|

| Tier 1 | Dry food, fresh produce, and soft drinks producers with more than 10,000 employees, excluding current customers and other accounts included in Do Not Contact list. |

| Tier 2 | Dry food, fresh produce, and soft drinks producers with employees ranging from 201 to 10,000 and packaging plants located East of the Mississippi River, excluding current customers and other accounts included in Do Not Contact list. |

| Tier 3 | Dry food, fresh produce, and soft drinks producers with 200 employees or less and packaging plants located East of the Mississippi River, excluding current customers and other accounts included in Do Not Contact list. |

| Do Not Contact | Current customers and other accounts excluded either because part of another business development initiative or for other reasons. |

With regard to the contact strategy, we made the following decisions:

- During the initial 4 months only Tier 2 and Tier 3 contacts should be added to prospecting campaigns.

- In any given period, prospects from Tier 3 should never be more than 20% of total prospects contacted.

- After completing a first set of process and content optimizations during the initial 4 months, each following month no more than 10 accounts from Tier 1 should be added to a prospecting campaign.

- On average, each week about 150 prospect contacts should be added to a prospecting campaign with no more than 3 prospect contacts from the same account.

Once the strategic guidelines are clearly defined and documented the Sales Development Team will be ready to start Phase II to setup the pilot program.

Phase II: Setup pilot program

The objective of Phase II is to setup all the processes and tools required to run account-based outbound prospecting campaigns and to develop supporting sales enablement materials (i.e. case studies, website landing pages, videos, etc.).

Usually the work is organized in five separate work streams executed in parallel:

- Create initial prospect accounts and contacts lists.

- Select and setup sales tech tools.

- Develop sales enablement content (i.e. case studies, videos, etc.).

- Develop prospecting campaign(s) and messaging templates.

- Update company website.

1. Create initial prospect accounts and contacts lists

To create lists of prospect accounts and contacts matching the ideal customer profile(s) and persona(s), the team will first need to select the appropriate sales intelligence tool(s) from which to source the data. Several tools exist and the team will have to decide which one is a better fit given their requirements and budget. Important aspects to consider include:

- Coverage: the total number of businesses and individuals included in the vendor database and specifically the coverage of the targeted countries and industry verticals.

- Quality of data: the amount and quality of information available for each business and person. LinkedIn Sales Navigator, for example, is an affordable tool but provides only limited information (i.e. no business email or direct phone number) entered directly by its users. A tool like Clearbit, on the other hand, is more expensive but aggregates information from more than 250 public and private sources and has proprietary quality controls to ensure that the data is accurate and up-to-date.

- Integration with other sales tools: prospects information will need to be automatically uploaded and kept in sync with other sales tools (i.e. CRM system, sales engagement platform, etc.). More expensive tools provide native integrations with some of the most popular sales tools (i.e. Salesforce, HubSpot, Marketo, etc.). Others require an additional workflow automation tool (i.e. Zapier.com, Automate.io, Tray.io, etc.) to automate the upload and syncronization processes.

- Search query UX: each tool will provide a user interface to specify search criteria (i.e. location, industry vertical, total revenue, number of employees, seniority, title, etc.). The number of available options and the interface ease of use are both factors to consider.

- API-based access to data: the best tools provide an application programming interface (API) to access their data. Others require manual exports or do not allow any export of data (in this last case sometime third-party tools can scrape the data from a web page).

- Pricing: a lot of different price points exist in the market that correlate with differences in coverage, quality of data, and functionalities. Some tools can be purchased on a month to month basis and others require an annual contract. As a reference, the unit cost per prospect contact for a sales intelligence solution (i.e. identify prospect, enrich data, and automatically upload data into sales systems) will typically range from as low as 25 cents to as high as $1.50.

A company just starting an outbound prospecting program with a limited budget could select and integrate a few simple sales intelligence tools to create a cost effective solution. For example, the following tools could provide a basic working solution at a total annual cost of about $4,500:

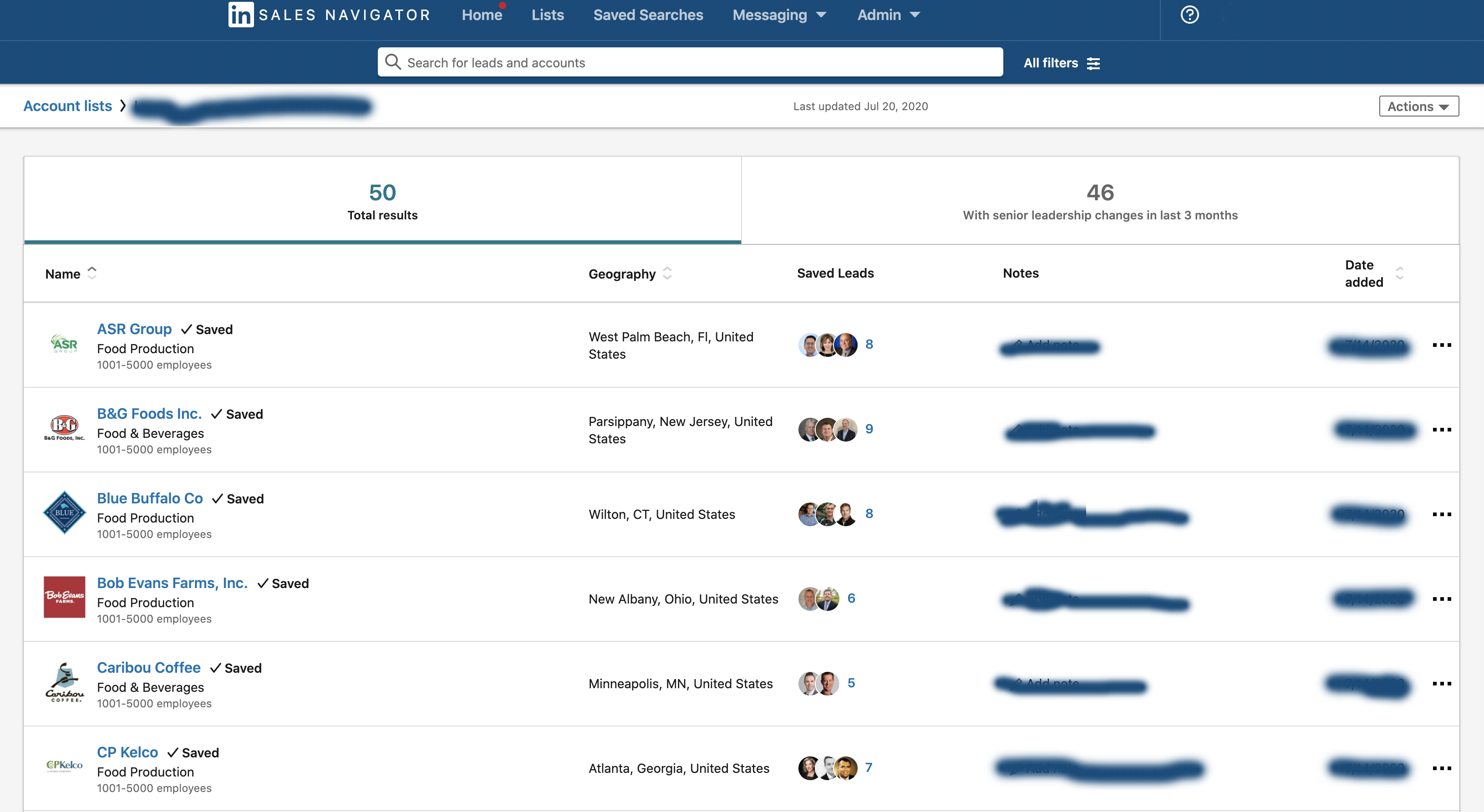

- LinkedIn Sales Navigator (about $850/year/one licence): to search for prospect accounts matching the ideal customer profile and prospect contacts matching targeted personas at those accounts.

- GetProspect (about $54.00/month for 1,000 prospects): to capture the information of selected prospect contacts from Sales Navigator and retrieve their business email address.

- Clearbit Enrichment (about $108.00/month for 1,000 prospects): to enrich a prospect contact business email with additional personal and company data (excluding the direct business phone number only available for an additional charge).

- Zapier (about $140.00/month): to automatically capture the data from GetProspect and Clearbit and update the selected CRM system and Sales Engagement Platform (i.e. the tool used to manage prospecting campaigns).

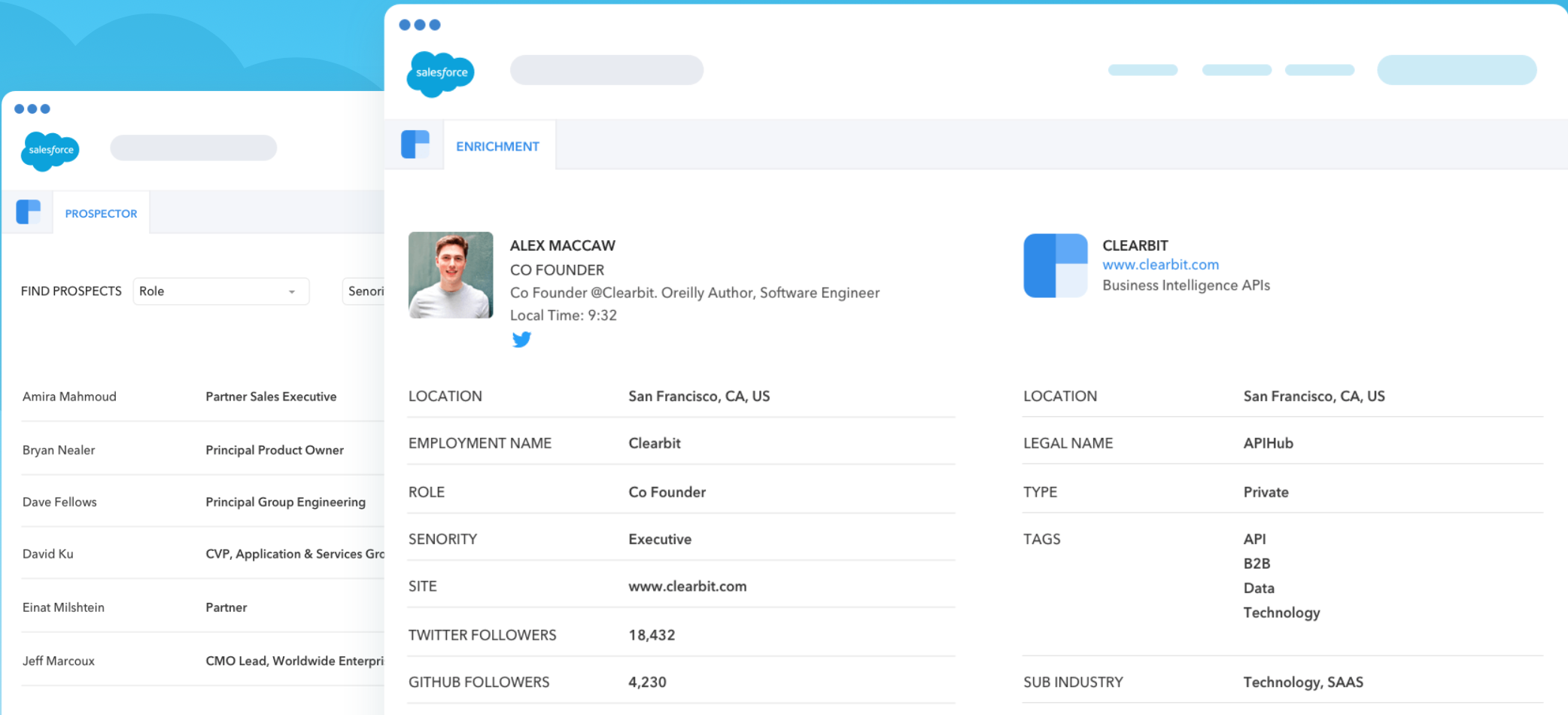

A company already using Salesforce as a CRM system, with a greater available budget, and looking for a more permant solution should instead consider a more capable tool like Clearbit Prospector (or another leading tool like ZoomInfo, DiscoverOrg, or Datanyze]).

In this case, with just one tool a user would be able to search for prospect accounts matching the ideal customer profile from within Salesforce, identify key executives matching the targeted personas at those accounts, automatically create account and contact records in Salesforce with enriched profiles (including a business email and a direct business phone number), and automatically update those records every 30 days. Pricing plans for Clearbit start at $20,000 annually and depends on CRM database size and monthly prospect contacts created.

Once the selected sales intelligence tool(s) are setup, typically the Research Analyst will start creating the lists of prospect accounts and contacts matching the ideal customer profiles and personas defined in Phase I. To make the process more manageable, it's a good practice to create multiples lists including smaller groups of accounts and contacts (i.e. accounts from a specific industry vertical, of a certain size, based in a specific geography, etc.). This will facilitate the testing of alternative targeting strategies. An example of the output of this work using LinkedIn Sales Navigator from our case study is included below.

During the setup phase the Research Analyst will typically be required to create lists with enough contacts to feed the initial 6 to 8 weeks of the outbound prospecting campaign(s). Each week during the setup phase the output of the work completed (i.e. search queries, lists of selected accounts and contacts, and lists of discarded accounts and contacts) will be reviewed with the Sales Development Team leader and the SDR(s). Adjustements will be made when needed and all decisions made will be properly documented for future reference.

After the initial setup phase, new accounts and contacts matching the ideal customer profile(s) and persona(s) will be researched and added to the systems on an ongoing weekly basis always maintaining a buffer of a few weeks to ensure uninterrupted execution of the outbound prospecting campaigns.

Data breadth and quality have a huge impact on the results produced by an outbound prospecting program and investments in better data usually have a very positive ROI.

2. Select and setup sales tech tools

Depending on the size of the company, the sales process type (i.e. high velocity or high touch), and the preferences expressed by the sales team, the set of tools used to manage the sales process end-to-end can be relatively simple, with only a CRM system and a sales engagement system adopted in addition to the sales intelligence tool(s), or more complex with several other tools used to automate workflows, increase sales productivity, provide conversation intelligence, etc. (a partial list of leading sales tools covering a broad set of possible functionalities can be found here).

Evaluating, selecting, and properly integrating the right set of sales tools for a specific company is an important process that requires a clear understanding of how a company wish to operate, the program economics, and the alternative tools available in the market. For middle market companies, striking the right balance between improving productivity and ensuring ease of use is typically an important factor.

In this article we'll discuss only the two main systems, the CRM and the sales engagement platform, that in addition to the sales intelligence tool(s) are required to start an outbound prospecting pilot program. In this context, the sales engagement platform is the system used by SDRs to define and manage the outbound prospecting campaigns and the CRM is the system used by SDRs and AEs to track prospects engagement and to manage new sales opportunities. The CRM is also the system of record for all accounts and contacts data and for the sales metrics data (our reference sales metrics data model can be found here).

The market for CRM systems is very mature with many well functioning products. Salesforce is the undisputed market leader, but many other popular systems exist offering different set of functionalities at different price points (from about $300 / year / seat to $1,800+ / year / seat). Other popular systems include Hubspot, Microsoft Dynamics 365, Insightly, Pipedrive, and Copper.

All of the above CRM systems, and many others not mentioned here, when properly setup provide the key functionalities required to support outbound prospecting. These functionalities can be summarized as follows:

- Provide the system of record (i.e. the source of trusted company data) for accounts, contacts, sales opportunities and sales activities, with support for custom attributes (i.e. data elements captured for each entity) and API-based access to all data.

- Manage accounts and contacts assignment to SDRs and AEs to identify who is the primary person in charge of each prospect, lead or customer.

- Manage multiple customizable sales pipelines (i.e. worflows of stages and activites required to achieve a given sales goal). For outbound prospecting two sales pipelines are usually required:

- Prospecting pipeline: used by SDRs to track the process of reaching out and qualifying prospects. Usually this workflow is setup with the following stages: Disqualified (i.e. prospects with invalid contact information, that opted out or declared to be not interested, or that upon further conversations have been deemed not a good fit for the company), Unresponsive (i.e. prospected that have been assign to one or more campaigns but did not reply yet), Working (i.e. prospects currently assigned to a campaign), Engaged (i.e. prospects that replied to a campaign), Interested (i.e. prospects that replied and expressed interest in connecting with an SDR), Qualified (i.e. prospects that after one or more discovery calls have been qualified by an SDR as a new sales opportunity), Accepted (i.e. prospects accepted by an AE as a new sales opportunity).

- New Opportunities pipeline: used by AEs to track the process of managing new sales opportunities. Usually this workflow is setup with the following stages (or a similar variation selected by the sales team): Opportunity Identified, Stakeholders Engaged, Needs Defined, Proposal Made, Negotiation Started, Won/Lost.

- Provide a sharable central repository to track all sales related activities (i.e. tasks, meetings, calls, etc.).

- Automatic syncronization with individual productivity tools (i.e. email, calendar, to do, etc.).

- Manage email templates and track email opening and link opening.

- Tracking of relationships between entities and API-based access to all managed entities (i.e. Accounts, Contacts, Sales Opportunities, Activities, etc.).

- Worflow automation to minimize sales team members manual data entry requirements and maximize data integrity (this can be provided natively by the CRM system or added with a separate worflow automation tool as long as the CRM system provides API-based access to all data).

- Source of truth for sales metrics data (see the appendix of a previous article for our sales metrics data model) and other valuable qualitative information (i.e. prospects major pain points, reasons why deals are lost, etc.). Capturing this information is one of the greatest benefit provided by a CRM system as the data is key to assess sales performance and identify opportunities to improve the sales process.

The market for sales engagement systems is less mature, as most of the tools are less than 10 year old, but nevertheless several products exist offering different set of functionalities at different price points (from about $350 / year / seat to $1,600+ / year / seat).

Outreach is the leading tool in this market and SalesLoft and PersistIQ are also mature and well functioning products that have all the required functionalities (a broader list of sales engagement systems can be found here).

The key functionalities that the selected sales engagement system should be able to support can be summarized as follows:

- Import and manage prospects' lists with custom attributes, assignment of those prospects to owners (i.e. SDRs), and syncronisation of prospects data with a CRM system either through a native integration or an integration with a workflow automation tool.

- Define and manage prospecting campaigns as sequences of manual or automatic steps (i.e. tasks, phone call, emails, etc.) to be performed at predefined time intervals and in specific time windows.

- Create and manage email templates that can be personalized with data specific to each prospect, scripts for phone calls, and guidelines for tasks.

- Automatic logging of emails sent and phone call notes into CRM system.

- Tracking of email opening and link opening to measure campaigns performance.

- A/B testing of emails subject lines and body text to optimize campaign performance.

- Intelligent automations:

- Do not contact domains list: the system can store a list of domains to which emails should never be sent (i.e. existing customers, accounts included in other business development programs, etc.).

- Duplicate prospect detection: the system automatically blocks the upload of a new prospect that has an email address already existing in the system.

- Campaign safety checks: when trying to add a prospect to a campaign the user is automatically notified when a potential issue is detected (i.e. the prospect bounced, opted out, or is already included in another campaign).

- Intelligent responce detection: the system can detect when a manual reply to an email sent is received or when the message received is an automatic reply (i.e. out of office message).

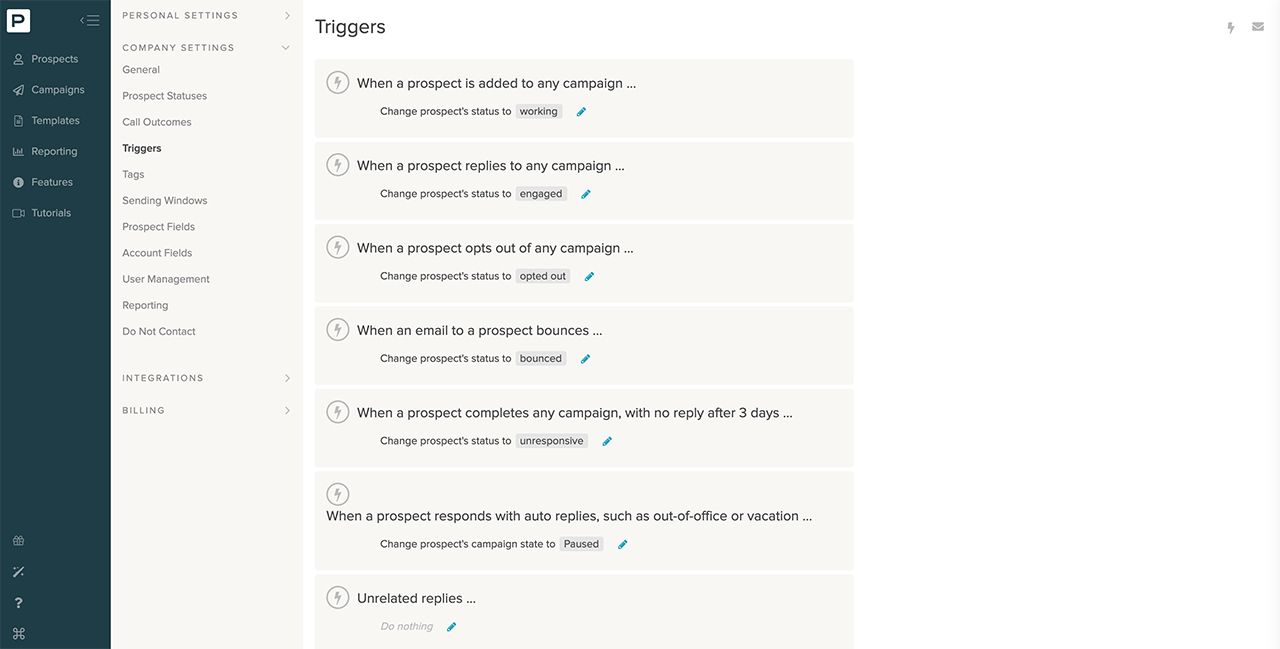

- Automatic triggers: ability to define a set of automatic actions in response to specific events (i.e. when an email sent bounce then set prospect status to bounced and set campaign status to finished; when a manual reply is detected then set prospect status to engaged and set campaign staus to finished; when an automatic reply is detected do not change prospect status and set campaign status to paused; when after a phone call a user manually set the prospect status to engaged then set campaign status to finished; etc.).

- Real-time signals and periodic reports to help manage and optimize the prospecting process (i.e. open email alerts, activity feeds, prospect activity history, performed activities reports, campaign performance reports, etc.).

The initial setup of the selected sales engagement system will require the integration with SDRs individual email mailboxes, the integration with the sales intelligence tool(s) feeding the new prospects data, and the integration with the CRM system.

The image below, for example, illustrate the page used to setup automatic triggers in PersistIQ.

3. Develop sales enablement content (i.e. case studies, videos, etc.)

Sales are driven by content that support buyer and seller conversations. Sales reps need content, tools, and training that help them share a compelling perspective about the unique value that a company's product or service brings to help buyers more easily solve their problem.

Case studies are a very effective way to tell self-contained stories of how a real customer overcome their problem by using a company product or service. By the end of a case study, a reader should be able to visualize themself as the hero of the story able to overcome their problem and achieving their objectives.

A case study can be produced in several formats (i.e. a blog post, an eBook, an infographic, a video, etc.) to support different media channels and use cases.

Hi ,

This is from . I'm writing to ask if you'd like to receive a copy of a recently published >case study that illustrates how our customers using were able to achieve .

Please let me know if you're interested and I'll be happy to send you a copy.

Best Regards

According to B2B Marketing, 66% of 112 B2B marketers surveyed said case studies were very effective, while 32% said they were quite effective, at driving new leads and sales.

Several useful guides can be found on the internet explaining how to write professional business case studies that include examples and reference templates (i.e. here, here, here, and here). Key best practices can be summarized as follow:

- Define the case study's objective.

- Establish the case study medium(s).

- Find the right case study candidate(s) (i.e. customer(s)).

- Draft and send candidate(s) a case study release form.

- Write the case study following the classic narrative arc.

- Use data and visuals to illustrate key points.

- When possible, let the customers tell their own stories (i.e. use quotes and testimonials).

Narrative Arc illustration by reedsy

Based on the messaging strategy defined in Phase I, the Sales Development Team will select the case study candidates, process the legal paperwork, write the case study outline, complete the required interviews, and collect the required supporting data. After that, working with a selected service providers (for example, ClearVoice or UpWork) a professional business writer and a graphic designer will be retained to develop the case studies.

In our case, we decided to develop 6 case studies illustrating how the company had helped existing customers solve their problem and achieve their goals. For each case study, an infographic in pdf format and a full case study eBook in pdf format were produced to be used by SDRs as an attachment to emails.

When appropriate and compatible with the available budget, a company might invest in the development of some videos (i.e. for a message from the CEO or SVP of sales, customers' testimonials, a facility tour, etc.). Most B2B marketers agree that the second most effective content format is video.

4. Develop prospecting campaign(s) and messaging templates

Developing effective outbound prospecting campaigns requires mastering multi-touch and multi-media cadences or sequences. A cadence is the number and rhythm of attempts made by SDRs to reach out and engage prospects.

Many books are available that discuss how to develop effective cadence and messaging strategies for prospecting campaigns. Most books also provide several examples and templates. In addition to the books listed in our first article in this series, a broader list of books can be found here.

In this section, first we're going to introduce a few key concepts and best practices derived from those readings and many years of personal experience and then we'll review the choices we made in our case study.

To craft a successful sales cadence for a prospecting campaign there are five elements that need to be defined, tested, and fine-tuned over time:

- Attempts: the total number of touch points made. Effective sequences should have enough touches to be professionally persistent but avoid being annoying. Typically 6 to 10 touches produce the best results.

- Media: the type of communication methods used (i.e. calls/voicemails, emails, LinkedIn messages, etc.).

- Duration: the time between the first and last attempt. Effective sequences usually are 14 to 21 day long, depending on the number of media channels used and the number of available case studies.

- Spacing: the time gaps between contact attempts. A good well tested rule is to touch in each channel every three to six days.

- Content: the text used in voicemails and emails, the attachments or videos included in emails, etc..

Implementing a formal and consistent cadence is a must, as the routine helps SDRs master the game by taking away uncertainties around the process, and the most effective media channels are calls/voicemails and emails.

While it's true that calls are more expensive and diffucult to execute and that completing a prospecting phone call (i.e. connecting live with a prospect) is very difficult nowadays, it's also true that a good voicemail might link a company name to an internal pressing issue and prompt a prospect to reply to a previous email. Several studies and field experts agree that including phone calls/voicemails in prospecting campaigns increases conversion rates and has a positive impact on ROI.

When drafting scripts for calls and voicemail, simple but effective guidelines include the following key points:

- Be different and be relevant (i.e. state reason for the call and share relevant information).

- Be specific with the ask (i.e. state simple action and benefit to prospect).

- Don't reference previous attempts (prospects don't care).

- Don't trick prospects (i.e. don't leave deceiving messages or imply previous connections if that is not true).

- Keep voicemails short (i.e. no more than 30 seconds).

Effective email templates are also short (i.e. ideally less than 300 words), need to have significant personalization (i.e. with specific information beyond just the contact's first name and the company name), and should be structured in three main parts:

- The Open: the subject line and the first sentence in the body text are the first and only shot at keeping the prospect's finger off the delete button (must be short, relevant, and generate curiosity).

- The WIIFM: this is the second sentence and the core of the email that articulates what's in it for the prospect. What value are we offering and why should they care and reply. The key is to get to the point succinctly, with personalization, and speaking to a specific professional challenge.

- The Ask: this is the call to action (CTA). The more clear and simple is the ask, the higher the reply rate will be.

Subject: Helping achieve

Hi ,

This is from , a provider of flexible packaging solutions for the Food & Beverages industries.

I'm writing to ask if you'd like to receive a copy of a case study that illustrates how our customers using were able to achieve . I'm confident we could do the same for your and .

Please let me know if you're interested and I'll be happy to send you a copy.

Best Regards

With some good guidelines on how to structure effective outbound prospecting campaigns, the next step is to define how many campaigns to prepare for launch and to set them up in the selected sales engagement system (the number of used campaigns will usually increase over time as the program expand in scope and size).

The number of required campaigns is typically driven by the number of targeted industry verticals (as different verticals might requires different messaging) and personas (as a campaign targeting executives in Sales & Marketing might require different messaging from one targeting executives in Operations and Supply Chain).

In our case, to simplify the initial work we decided to launch with just one campaign defined as follows:

- The campaign cadence would include 1 initial task (to verify each prospect had valid data) and 7 touches over a 15 business day period (i.e. 4 emails and 3 calls/voicemails).

- Emails would automatically send in the morning of day 1, 4, 8 and 15. Calls / voicemails would be done by the SDR in the afternoon of day 1, 5, and 11.

- The first three emails would offer to share a case study (see first email template above), with each email referring to a different case study. The script for the 3 calls / voicemails would be the same used for the first 3 emails. The last email would be a break-up email, expressing regret for the missed opportunity to connect and an intent to re-connect in a few months.

- To enhance personalization at scale (i.e. without having to write each email manually), the data sourced from the sales intelligence tools would be enriched by the Research Analyst with information about two products with a good fit (i.e. and ) manually researched for each targeted account. The specific product names would be added to the prospect database in custom attributes and then used in email templates.

5. Update company website

While not strcitly necessary, updating some of the company's website content to reflect the new messaging strategy is often recommended.

Also, in industries with good volumes of organic search traffic, creating a few landing pages to allow visitors access the case studies after entering their contact information would also be beneficial. Down the road, when both the search volume and the number of case studies are high, building a landing page that allows visitors to search and filter for available case studies is also a good practice (an example from ASW can be found here).

Finally, when the website is old and slow, refactoring the website to provide a modern look, fast response times, and easy navigation is a small investement in branding that can help a company project a more appropriate image.

Phase III: Launch initial campaign(s)

It's Monday morning in launch phase Week 1 and the SDR(s) will finally start testing the new account-based outbound prospecting campaign(s). In our case, during the launch first day the SDR did the following:

- Selected 21 prospect contacts from the ones previously uploaded into the system and added them to the prospecting campaign.

- Controlled that all data fields used in email templates had valid data (i.e. first step in the campaign cadence) and move prospects to the second step in the cadence (i.e. send first email).

- Controlled that emails were properly sent, that the bounce rate did not exceed 5%, and checked initial open rates.

- In the afternoon, made the first phone calls to the selected 21 prospect contacts, checked that at least 90% of the phone numbers were valid, and left 17 voicemails following the provided script.

The first couple of weeks after launch are typically not very busy and this is why it's a good practice to combine the normal SDR(s) activities with some form of training. In our case, during the first week the SDR selected and added to the prospecting campaign 121 prospects, automatically sent 242 emails and checked open rates by end of week, reviewed and managed 7 replies, attempted to make 242 phone calls using the tool click-to-call functionality, spoke live with 2 prospect contacts, left 213 voicemails, and scheduled 3 discovery calls for the following week.

After a few weeks the situation is usually significantly different as more and more prospect contacts are added to the prospecting campaign(s). In our case, with the duration of the prospecting campaign being 3 weeks, the activity peak was reached in Week 4. In that week, our campaign cadence had 150 prospect contacts in their third week, 150 in their second week, and another 150 in their first week. The resulting SDR activities in Week 4 since launch were the following:

- Selected and added to the prospecting campaign 150 prospect contacts.

- Automatically sent 600 emails.

- Reviewed and managed 19 replies.

- Attempted to make 600 voicemails, spoke live with 5 prospect contacts, and left 529 voicemails.

- Made 11 discovery calls with engaged and interested prospect contacts.

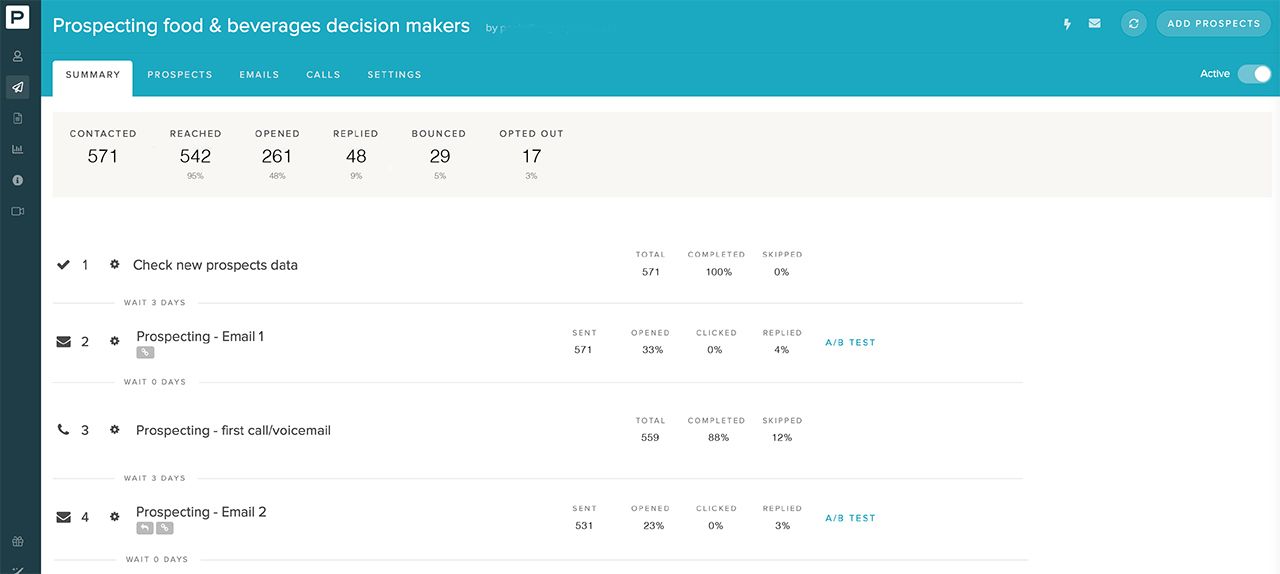

The image below shows a copy of our outbound prospecting campaign results after the first 4 weeks.

During the first 4 weeks after launch our campaign had tried to reach 571 prospect contacts, had reached (i.e. by delivering an email or completing a phone call) 542 prospect contacts, and had received 48 replies:

- 7 prospect contacts replied saying they were not interested.

- 23 prospect contacts replied saying they were interested (i.e. wanted to receive the case study) but that the best time for a follow up call would be a few months down the road.

- 18 prospect contacts from 11 prospect accounts replied saying they were interested and wanted to schedule a follow up phone call with the SDR.

During the last three years prior to the launch of outbound prospecting our flexible packaging company had acquired only 5 new accounts. In the first four weeks of outbound prospecting, the company reached out to 103 new prospect accounts and was able to engage 11 new accounts. The program had a clearly successful start.

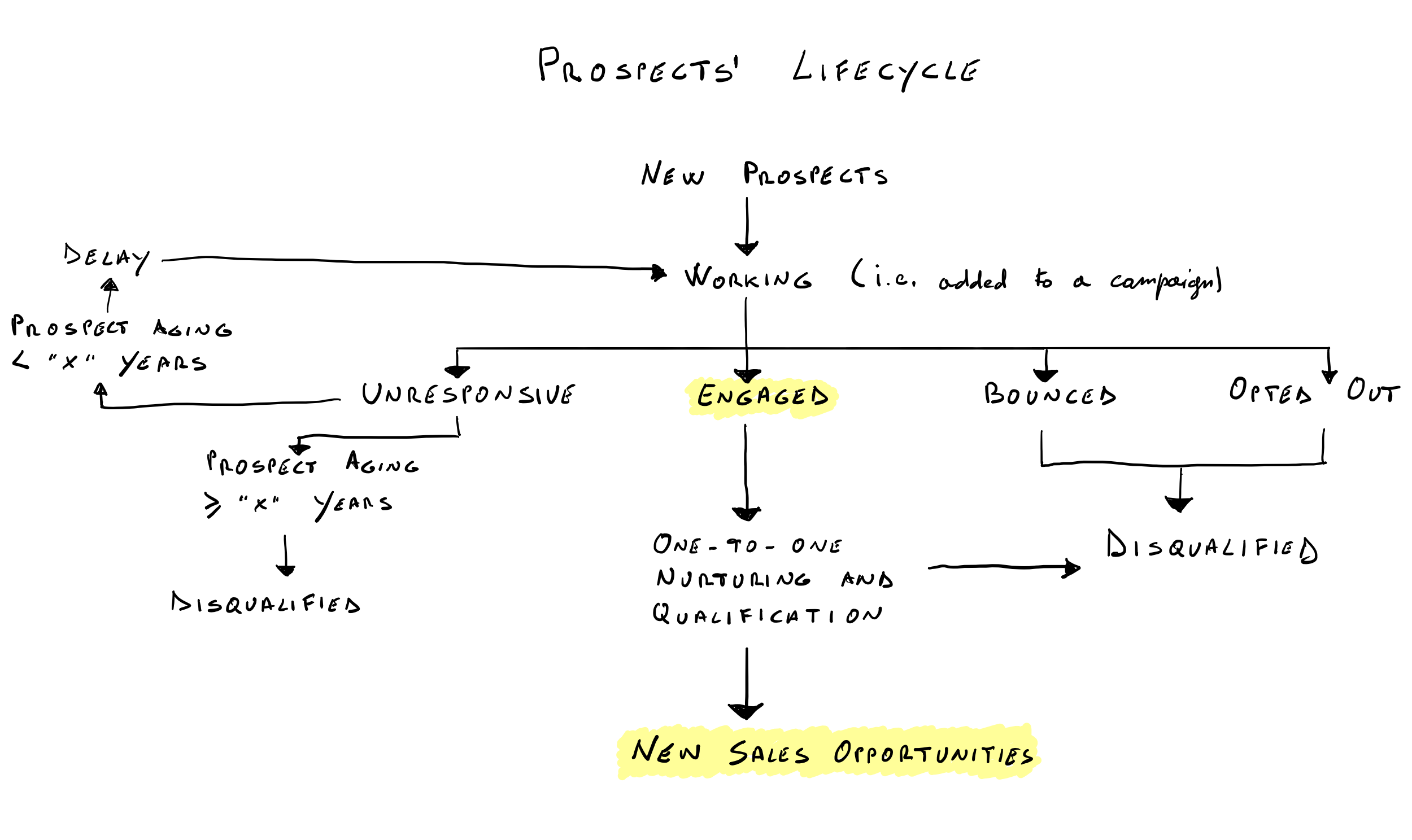

An important factor in order to maximize the long term performance of an outbound prospecting program is to properly manage the prospects' lifecycle as illustrated in the following chart.

The first step is to properly setup the campaign(s) automatic triggers to properly handle bounced and unsubscribed emails. In both cases, the system will automatically set the prospect status to disqualified so that the prospect contact will never be contacted again.

The second step is to provide specific guidelines to SDRs about how to handle replies:

- Not interested: some prospect contacts will not unsubscribe from the email but simply reply that they are not interested. In this case the SDR should manually changed the prospect status from engaged to opted out/disqualified.

- Interested but not ready: other prospects will instead send a neutral reply expressing interest (i.e. asking for the case study) but resisting the attempt to engage (i.e. too busy, not a good time, etc.). In this case, the SDR will need to start a nurturing process by sending a thank you email and setting an activity reminder to follow up with the contact at a later date in the CRM system. The CRM system will also automatically change the contact classification from Prospect to MQL.

- Interested and ready: the third possibility is a positive reply in which the prospect contact confirm their interest in a follow up call. In this case, the SDR will start the prospect qualification process by scheduling the first discovery call (the CRM system will also automatically update the contact classification from Prospect to MQL). Through one or more discovery calls the objective of the qualification process is to allow the SDR to discover if the prospect account has a problem that could be solved by a product or service offered by the company, if the cost of inaction would be significant and the account appears to be willing to act now, and if the prospect contact has sufficient authority and interest to connect with an Account Executive for a more in depth discussion. When the outcome of this process is positive, the SDR will change the contact classification from MQL to SQL and organize an introductory call with an Account Executive. When the outcome is negative, the prospect contact status will be set to disqualified.

The third and final step is to define how to handle unresponsive prospect contacts (i.e. have valid contact information, did not opt out, but did not reply). This group will represent the largest outcome of a prospecting campaign. In our case, for example, out of 571 prospect contacts added to the campaign during the first four weeks after launch, 477 prospect contacts ended up being unresponsive (i.e. 83.5%.).

The best approach for unresponsive but relatively new prospect contacts is to add them to a follow up prospecting campaign. That campaign will start with a delay of 3 to 6 months and then start a new sequence for a new attempt to try to engage a prospect contact. Unresponsive prospects with a significant aging, typically 18 to 24 month old, will instead be deemed to be not interested (i.e. disqualified).

Conclusions

In today's environment many B2B companies with a compelling value proposition and a serviceable addressable market (SAM) that includes from a few thousands to a few hundred thousands prospect accounts need a cost effective and scalable approach to accelerate the acquisition of new customers. Leveraging data, structured processes, and intelligent automation an outbound prospecting program is the digital solution that meets those requirements.

A cost effective and scalable outbound prospecting program can usually be setup and launched in 12 to 16 weeks.

In 4 to 6 weeks after launch the program will produce initial hard evidence regarding its ability to engage new prospect accounts. Usually, the program performance will continue to improve during the following 12 to 24 months as a result of ongoing process and content optimizations.

After 6 to 9 months from launch the program will also provide factual data regarding a company's ability to offer a compelling value proposition to prospective new customers and suggestions on what to do to increase its competitiveness.

When successful, over a 4 year period the program will make a significant contribution to equity value creation. When not successful, if managed properly the program won't have a negative impact on a company net financial position at the end of the 4 year period.