Investment, Risk And People Management In Portfolio Companies' Digital Transformation

How can we encourage management teams to embrace and support digital transformation? How much investment will be required? How can we mitigate the financial risks? These are essential questions that many middle-market private equity investors are currently trying to address. Here we share some ideas and guidelines to help move forward digital transformation initiatives.

The IDC's Worldwide Digital Transformation Guide predicts $1.97 trillion will be spent on digital transformation in 2022, a 52% increase relative to 2018 spending.

Investments in digital transformation are vast and accelerating. For technology companies trying to disrupt entire industries or large enterprises trying to defend their established market position from digital disruptors, the required investments can often span from several hundred million to a few billion dollars.

For most companies, however, digital transformation means something very different from outright disruption in which the old is swept away by the new. Change is involved, but more often than not, transformation means incremental steps to better deliver the core value proposition and enhance profitability, with much smaller required investments.

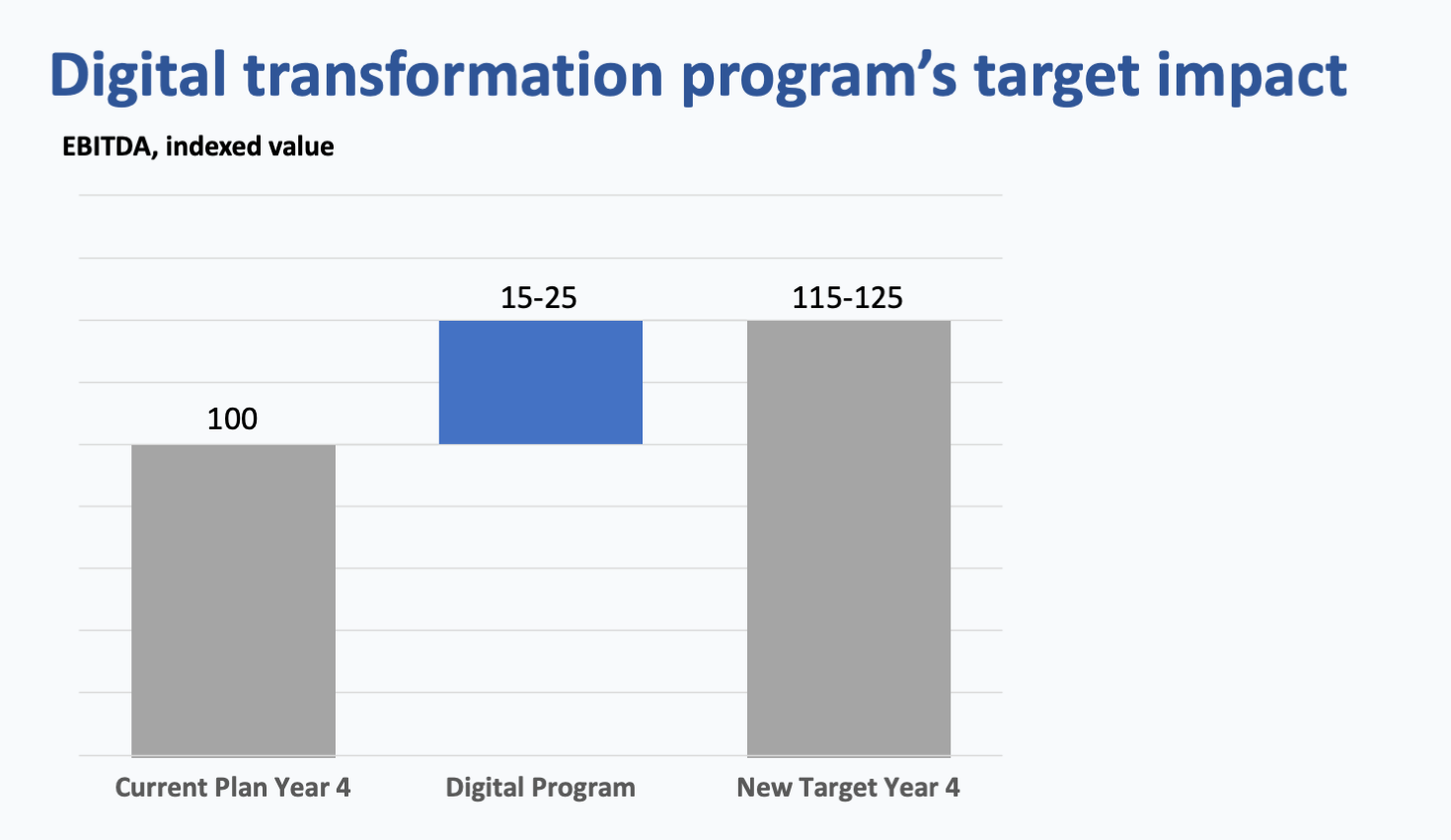

As a sequel to a previous article, our focus here is to produce a 15% to 25% EBITDA increase over a three to four-year period. We, at Augeo Partners, call it "growth-oriented digital transformation" and we focus on accelerating organic revenue growth and improving operational productivity. Based on our research and analysis, we believe that at most US-based middle-market private equity firms such a program could be successfully implemented at 20% to 40% of portfolio companies (in the previous article we also discussed how to identify the right candidates).

With proper program design and mitigating actions, the capital-at-risk at each company can be reduced to just a few million dollars or even close to zero in the most favorable circumstances. Yet, many middle-market portfolio companies still present significant digital capability gaps impairing their performance.

This article is for you if:

- You want to understand how to set top-down financial goals for a portfolio company's growth-oriented digital transformation program.

- You're looking to identify specific actions to mitigate the program's financial risks and minimize the capital-at-risk.

- You're considering how best to encourage a portfolio company's management team to embrace and support a growth-oriented digital transformation program.

After reading this article, you'll walk away with a better understanding of:

- Seven heuristic rules you can use to develop top-down estimates for a digital transformation program's key financial goals.

- Five specific actions you can take to reduce the program's capital-at-risk to just a few million dollars or close to zero in the most favorable cases.

- Three proven decisions you can embrace to promote management support and collaboration for a growth-oriented digital transformation change program.

- One successful strategy and plan to increase profitability at selected portfolio companies.

Setting top-down financial goals

In a context in which CEOs and Board of Directors usually overlook digital oriented matters, setting appropriate financial goals for a growth-oriented digital transformation program is often a challenge.

On one side, the CEO and the Board are well aware of the strategic importance of accelerating organic growth and strengthening digital capabilities. Still, they are unsure about how much to invest, where to invest, and what results to demand in return.

On the other side, a passionate group of internal or external digital experts is often vouching for investments in a multitude of initiatives (i.e., cloud services, SaaS tools, multi-channel digital lead generation campaigns, digital paid advertising, search engine optimization, e-commerce, data analytics, etc.) with an emphasis on non-financial metrics (i.e., web traffic, social media followers, new leads, faster response time, responsive design, operational agility, customer insights, etc.). As a result, important initiatives are often delayed or underfunded, and opportunities are missed.

This section outlines seven heuristic rules that can help CEOs and Board of Directors develop top-down financial goals for a growth-oriented digital transformation program at a middle-market company and initiate the conversation with the senior executive that will create a bottom-up plan and lead the program.

Defining the digital program scope

For a middle-market company, a growth-oriented digital transformation program aiming to produce a meaningful EBITDA increase while minimizing financial risks will usually span over a four-year period and pursue two objectives and five separate workstreams:

- Objective 1: Take market share away from weaker competitors.

- Workstream 1: Improving the effectiveness and efficiency of sales and marketing processes.

- Workstream 2: Improving data analytics to identify unprofitable and profitable customers.

- Workstream 3: Enhancing the core value proposition with value-adding services delivered through digital touchpoints (i.e., an e-commerce application, a customer service portal, etc.).

- Objective 2: Generate incremental cost savings.

- Workstream 4: Eliminating manual and repetitive tasks with workflow and robotic process automation in a few supporting functions (i.e., customer service, supply chain, finance, etc.).

- Workstream 5: Progressively migrating IT infrastructure and applications to the cloud.

The initial validation phase, focusing on accelerating organic revenue, will typically last from nine to fifteen months. After that, if successful, the program's scaling will start by ramping up efforts and investments and by gradually transferring all activities' governance to the internal management team during a two-year period. Otherwise, the program's spending will be curtailed, and efforts refocused on the cost-saving workstreams only.

Identifying the program's profitability drivers

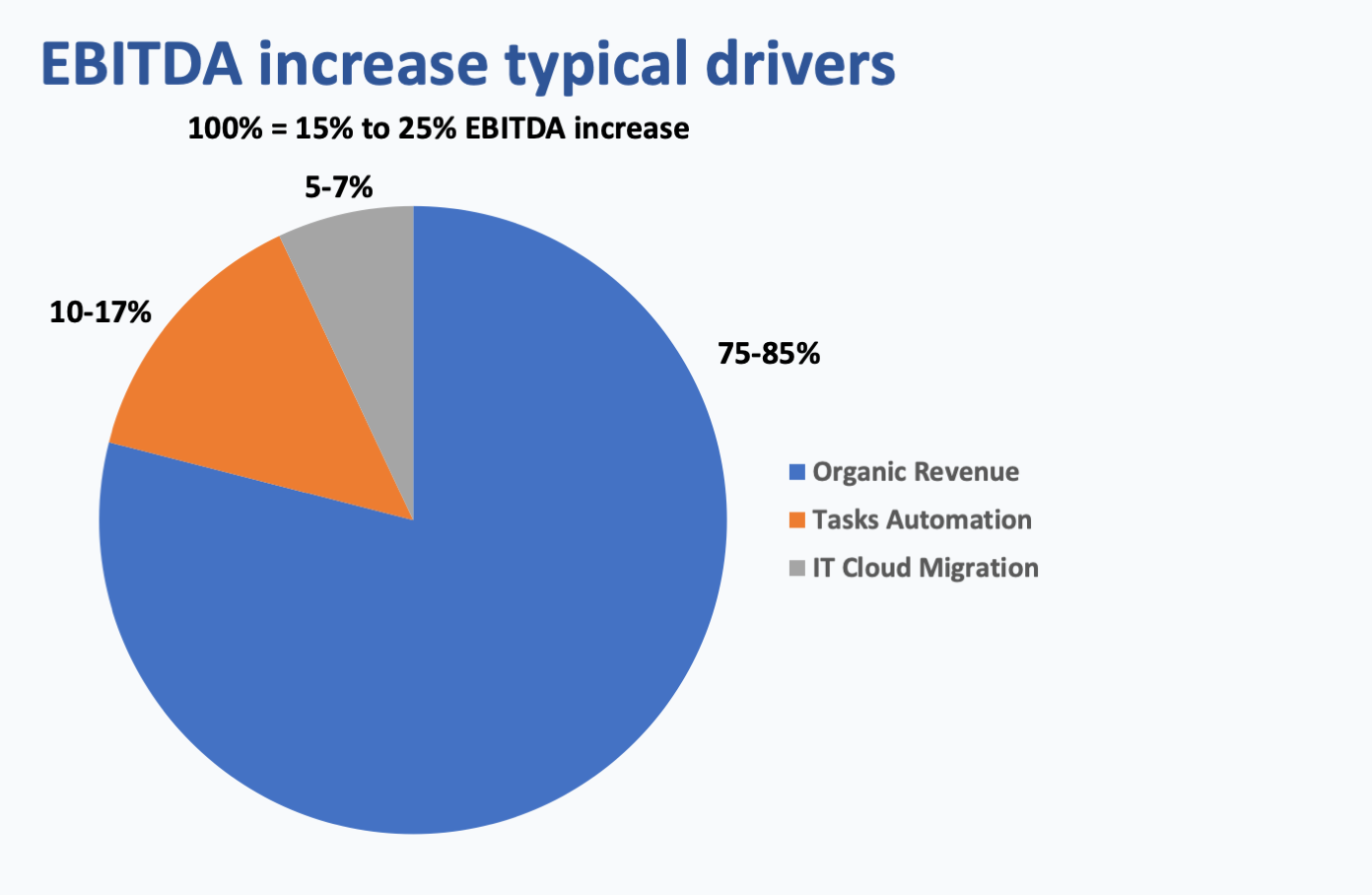

Normally, in a successful program, organic revenue growth will deliver 75% to 85% of the total EBITDA increase, and expense reductions will account for the rest. More specifically, the drivers of the EBITDA increase will usually be:

- A 10% to 20% cumulative increase in organic revenue resulting from an acceleration in new customer acquisition, an increase in share of wallet at existing customers, or both, driving 75% to 85% of the total EBITDA increase.

- A 2% to 4% reduction in other operating expenses through intelligent automation of selected activities and processes (i.e., supply chain, finance, customer service, etc.), driving 10% to 17% of the total EBITDA increase.

- A 10% to 15% reduction in IT costs resulting from migration of infrastructure and applications to the cloud, driving 5% to 7% of the total EBITDA increase.

Developing top-down financial goals

CEOs and private equity investors need to quickly develop a better understanding of a few key financial metrics when considering such a program:

- The revenue increase required to deliver the targeted EBITDA increase.

- The digital program total spending over the four year period and year one spending level and drivers.

- The peak cumulative negative cash flow in both a best case (i.e., program working well) and worst case (i.e., program not working as expected).

- The capital-at-risk (i.e., potential negative impact on the company's net debt position in year four) in a worst case scenario, and potential positive impact on the company's net debt position in year four when successful.

Based on our experience, we have developed seven heuristic rules to help develop quick top-down estimates to inform initial discussions and set financial goals:

| Rule | Rule Description |

|---|---|

| Rule 1 | Set a target EBITDA increase ranging between 15% to 25%, assuming 85% will come from revenue increase and 15% from cost savings. |

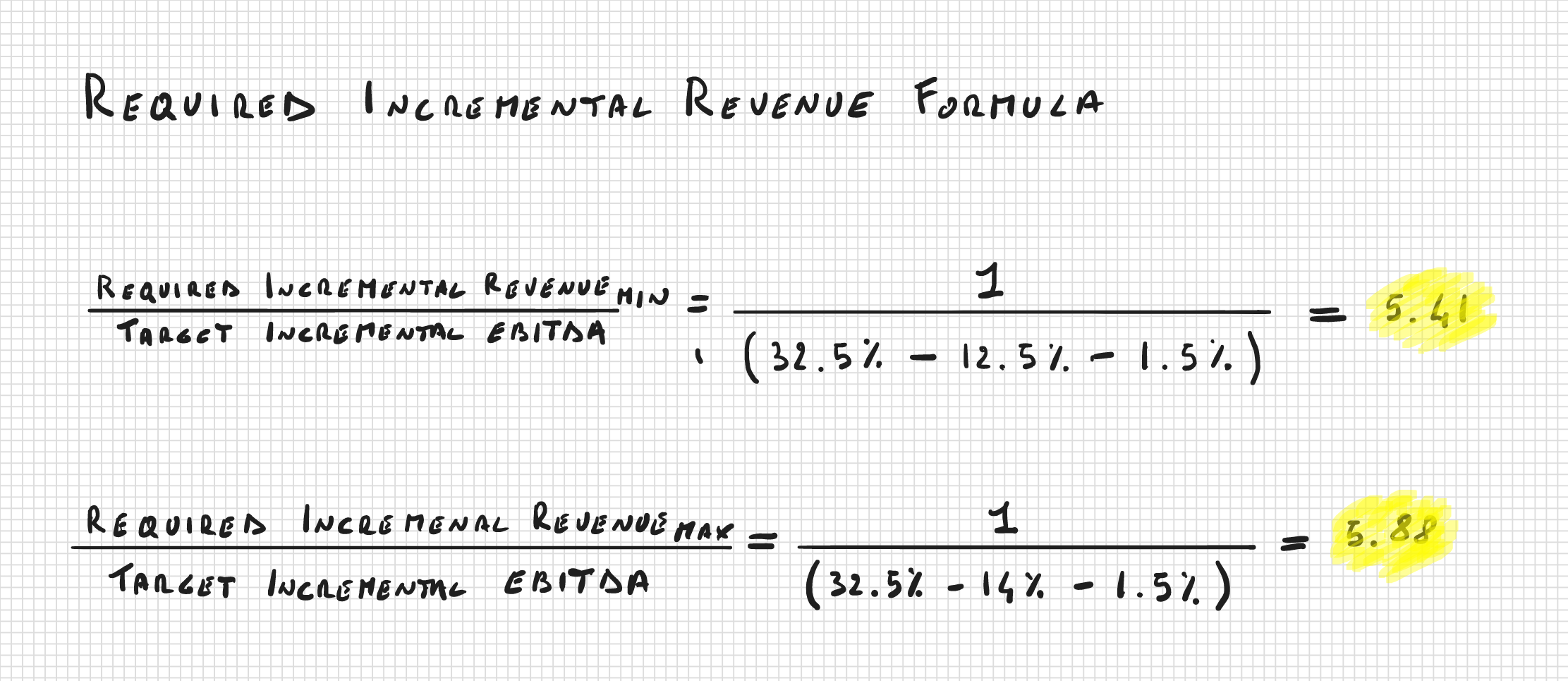

| Rule 2 | Assume 5 to 6 dollars of incremental revenue required to generate one dollar of EBITDA increase. |

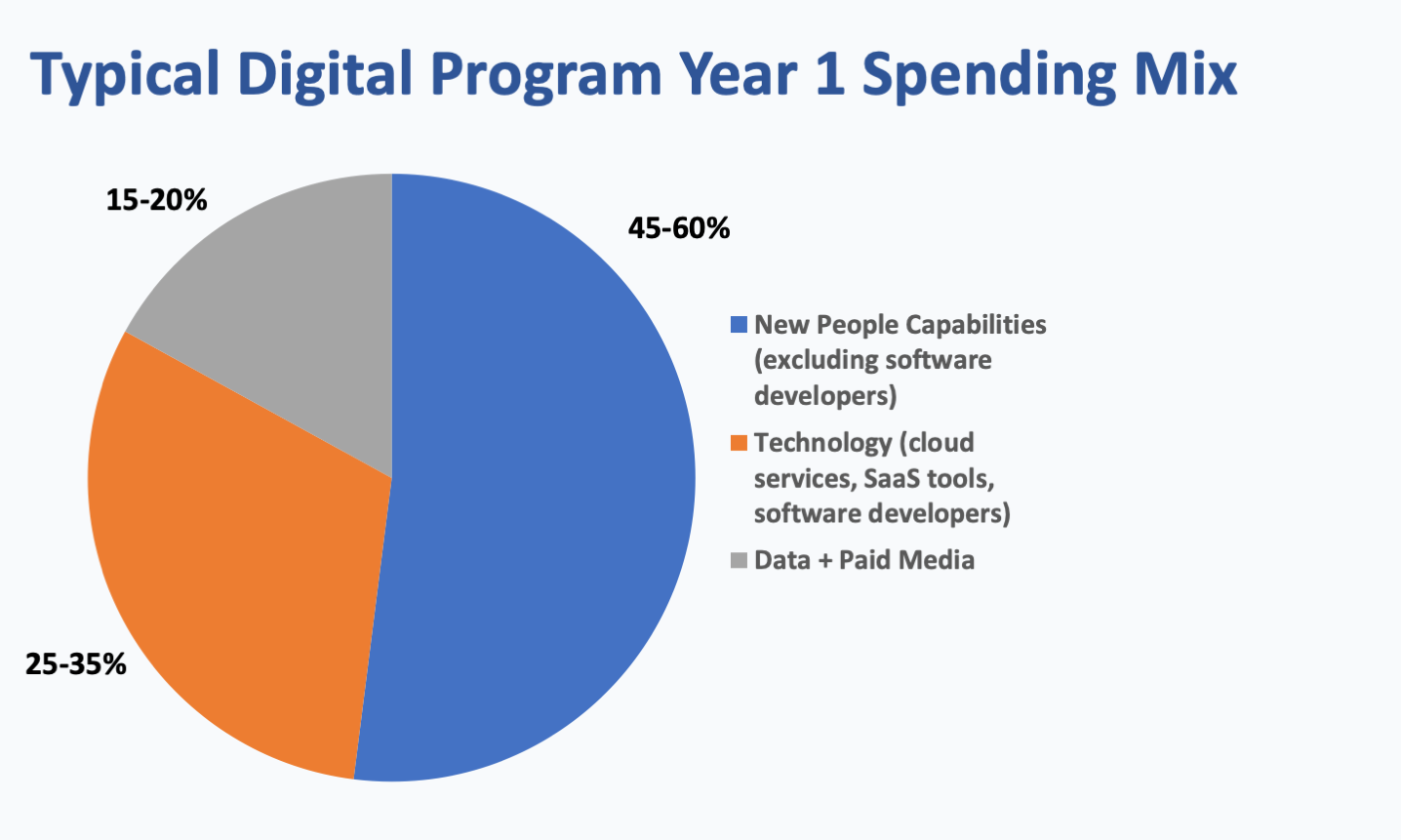

| Rule 3 | Estimate total program spending in year 4 as a percentage of revenue between 12.5% and 14% for B2B companies, and between 20% and 25% for B2C companies. |

| Rule 4 | Estimate the program total spending over four years at about 3x the program spending in year 4. |

| Rule 5 | Budget the program spending in year 1 at about 10% of the estimated total program spending over four years. |

| Rule 6 | Assume the program will have a peak negative cash flow in year 2, and cap that value at about 1.5x the budgeted year one spending when early metrics track well and at 1x otherwise. |

| Rule 7 | Assume year 4 impact on the net debt position to be, in the worst case, a negative value close to zero when revenue increase and cost-saving workstreams can be combined, or 50% of year 1 spending when working on revenue increase only. In the best case, assume a reduction in the net debt position of about 1.1x to 1.3x the EBITDA increase in year 4. |

With these seven heuristic rules and three company-specific data points (i.e., year four projections for EBITDA, gross margin, and G&A variable costs as a percentage of revenue), it is possible to generate a pretty robust set of top-down financial goals.

To illustrate an example, we'll refer to the case of a B2B middle-market company that wants to target a 20% EBITDA increase over four years relative to current projections. In year four, the company's current financial plan estimates an EBITDA of 60 million dollars, a gross margin equal to 32.5%, and G&A variable costs as a percentage of revenue equal to 1.5%.

Applying the above heuristic rules to the company's specific data will output the following top-down financial goals and guidelines.

To generate an incremental annual EBITDA of 12 million dollars, the company will need to develop between 55.2 and 60 million dollars in incremental annual revenue and 1.8 million dollars in additional annual cost savings in four years.

- The digital program's total annual spending in year four, if successful, will range between 6.9 and 8.5 million dollars. The cumulative program spending over four years will range between 20.7 and 25.5 million dollars.

- For year one, the digital program budget will be between 2.1 and 2.5 million dollars in spending.

- The peak negative cash flow will occur in year two and will be capped at 3.75 million dollars when early metrics will track well and at 2 million dollars otherwise.

- In a worst-case scenario, the negative impact on the company's net debt position in year four will be close to zero if cost-saving opportunities are confirmed and capped at 1.25 million dollars otherwise. When successful, the program will reduce the net debt position in year four by 13.2 and 15.6 million dollars.

With a clear definition of the digital program scope and its financial goals, the CEO and the Board will be ready to engage with the senior executive selected to lead the effort. Our recommendation is to retain an affiliated or independent digital operating partner acting as an interim part-time digital transformation officer with a performance-based compensation.

In the first 18 to 24 months, the senior executive's primary focus will be to design, validate through trials and errors, and scale the digital program. After that, the focus will shift to transitioning the governance to the internal management team and helping with hiring and coaching as appropriate.

Minimizing capital-at-risk

Pursuing upside opportunities while minimizing capital-at-risk is very important for buyout private equity investors. Following are five mitigating actions that can help to significantly reduce financial risks and, in the best cases, ensure that the digital program is self-funded.

Start from improving sales and marketing processes

Generating greater interest and engagement with new prospects and existing customer is the most challenging task and, therefore, the right place to start with. During the first four to six months, the digital program focus should be on launching and validating new campaigns aiming to generate new qualified leads, stimulate greater spending from existing customers, or both. Funding additional investments for an ecommerce application or an advanced customer analytics application should follow some initial market validation.

Stage spending based on sales-funnel metrics

The release of the digital program spending should be in stages based on meeting specific sales-funnel metrics. The first-year budget should allow about 10% of the program's projected total expenditure, with 35-40% of the budget allocated to the first semester and the remaining to the second semester.

Initially, the campaigns will have a limited scope in terms of products, customer segments, and geographies to contain spending. During the first four to five months, the objective will be to validate greater engagement with new qualified leads, existing customers, or both. In the following six to nine months, the focus will shift to turning the greater attention into new opportunities, and finally, actual sales. After that, the digital program will start scaling to include more product categories, customer segments, and geographies.

Usually, after six to eight months, with reasonable evidence regarding the capability to generate new opportunities, funding for other investments like the development or improvement of an ecommerce application is also released.

Invest to deeply understand customer profitability

Taking a good aim is very important in many games. It is imperative when working to accelerate organic revenue through digital transformation. Data and new digital tools will give a company new super-powers and the ability to reach any potential customer, across multiple channels, and with multi-media messaging. Knowing where to focus will be essential to generate positive operating profits.

According to Jonathan Byrnes, Senior Lecturer at MIT, nearly 40 percent of every company business is unprofitable by any measure, and 20 to 30 percent is so profitable that it is providing all the reported earning and cross-subsidizing the losses. The rest of the company is only marginal.

This issue is often even more severe at middle-market companies where a significant gross margin variance exists across different products, some customer segments are more price-sensitive than others, and supply chain costs can vary significantly depending on customer location and requirements.

Generally, traditional financial systems are not able to produce helpful customer profitability information promptly. Therefore, upfront ad-hoc analysis will be required to ensure that the new digital efforts will not chase visitors, followers, or unprofitable customers and instead focus on generating profitable revenue.

Balance growth-oriented and cost-saving workstreams

Companies that present digital capability gaps in their go-to-market approach are often also lagging in their ability to leverage intelligent automation in supporting functions and cloud services in their IT operations. While most of the upside will come from the revenue side, balancing growth-oriented and cost-saving workstreams will help further reduce the capital-at-risk and, in the most favorable cases, enable the design of a self-funded digital transformation program with practically zero capital-at-risk.

Be wise and flexible

Accelerating organic revenue is difficult as it depends on both internal and external factors. Potential customers might take longer than expected to embrace a compelling proposition. Campaigns that worked very well in the past might perform less well due to new competitive offers, and customer behavior and preferences evolve over time.

Forcing shorter time-frames and immediate results will often produce undesirable effects and increase financial risks. The digital program will need to accelerate spending before proper validation while increasing promotions to solicit a faster response from price-sensitive customers.

Playing the long game, focusing on learning from data, and continuous process optimization always produce the best results.

Encouraging management support

Senior management teams at middle-market portfolio companies are usually small in size and overstretched, operating plans already quite demanding, and resistance to change is a common human trait across all kinds of companies. Therefore, it is not surprising that the most common reaction when invited to consider the opportunity of a growth-oriented digital transformation program is: we don't have enough bandwidth.

Usually, embracing the following three decisions and sharing them during initial discussions will help achieve better and faster management support for a growth-oriented digital transformation program.

Provide separate funding and leadership

When approved, a growth-oriented digital transformation program should receive separate funding from the Board of Directors that will also appoint a new senior executive to lead the program. Misunderstanding about the source of funding or who will be accountable for the new targeted results will often create confusion and delays.

Do not change MBOs targets

During the first two to three years, the management team's MBO program should not be changed to reflect the new targets in terms of revenue and EBITDA increase. At most middle-market portfolio companies, the senior management team will lack digital expertise and, therefore, will be very uncomfortable when asked to assume responsibility for the new digital program. The proper way to manage financial risks is to minimize capital-at-risk through the digital transformation program's proper design.

Reward contribution with a long-term incentive program

Ensuring that the management team will provide proper support and collaboration to the new senior executive leading the digital transformation program will be essential for its success. Typically, the senior management team will participate in a stock option plan and benefit significantly from the program's success. Taking the time to explain the program's potential impact on the stock option value will help clarify the importance of the program. Creating a long-term incentive for executives critical to the digital transformation program's success but not included in the company's stock option plan will also be beneficial.

Given all of the above, are you ready to embrace and support digital transformation in 2021, or will you fall further behind? The time for action is now!

Digital transformation provide significant opportunities for most middle-market private equity investors and portfolio companies and, when executed well, no meaningful downside financial risks. The time to start is now, and Augeo Partners can help.