How Can Middle-Market PE Firms Best Support Portfolio Companies' Digital Transformation?

Can digital transformation have a significant impact on our portfolio companies' exit value? How can we identify the right opportunities in our portfolio? How can we best help our portfolio companies execute successful growth-oriented digital transformation programs? These are all critical questions most middle-market PE firms are currently trying to tackle. Here we share our expertise and ideas to help frame productive internal discussions.

A 2019 PwC report indicated that 75% of private equity firms surveyed planned to invest in portfolio companies' digitization over the next year to improve operational efficiency, accelerate revenue and earnings growth, and attain higher pricing multiples at the exit. Unfortunately, our analysis of the portfolio of about 30+ middle-market PE firms completed in Q4 2020 revealed that actual progress is often lagging.

This article is for you if:

- You're trying to assess the potential economic impact of getting portfolio companies' digital transformation right.

- You're looking at how to define a systematic approach to identify the right opportunities to focus on in your portfolio.

- You're considering how to best organize the execution of successful growth-oriented digital transformation programs at portfolio companies.

After reading this article, you'll walk away with a better understanding of:

- The main drivers of value creation in a growth-oriented digital transformation program at a middle-market portfolio company with a quantitative estimate of the potential upside.

- How to screen portfolio companies to identify the right candidates that present both a market opportunity and a digital capability gap (with a sample detailed interview guide, included at the end of this article, to help discover digital capability gaps in six key areas: new customer acquisition, customer lifetime value, e-commerce and customer service portals, BI & data analytics, operational productivity, and IT cloud migration).

- An analysis of the possible approaches to execution with a recommended course suggestion based on our experience.

The economics of digital transformation

Digital transformation is a very hot topic nowadays, and often the term means different things to different people. For some, it merely means migrating IT applications and infrastructure to the cloud. For others, it means developing an e-commerce website and investing in digital advertising.

For Augeo Partners, digital transformation has a broader scope, and it encompasses the following three areas:

- Pursuing "functional excellence" by injecting intelligence and automation in key business processes like retail & wholesale, marketing & sales, supply chain, IT operations, equipment maintenance, customer service, finance, etc.

- Promoting data-driven insights powered by machine learning and other technologies to improve decision-making, operational transparency and agility, and business performance.

- Driving "strategy & innovation" by:

- Enhancing the value proposition by creating digital touch-points (i.e., e-commerce applications, customer service portals, etc.) to facilitate further organic growth (i.e., sustaining price increases, reducing churn, accelerating customer acquisition, etc.).

- Expanding the addressable market by expanding the sales channels (i.e., developing an e-commerce website, establishing a precence on major online marketplaces, etc.) and, in some cases, developing a scaled-down version of the current offering.

- Strengthening the business' economic moat (i.e., increasing switching costs, introducing network effects, etc.).

At a portfolio company that presents both a market opportunity and a digital capability gap, implementing a pragmatic and fast-paced growth-oriented digital transformation program can drive an additional 10% to 25% increase in EBITDA and a multiple expansion of 5% to 15% over a 3 to 4 year period (relative to the management base case).

Typically, the key drivers of those results are:

- A 10% to 20% cumulative increase in organic revenue.

- A 10% to 15% reduction in IT costs driven by migration of infrastructure and applications to the cloud.

- A 2% to 4% reduction in other operating expenses driven by intelligent automation of selected activities and processes (i.e., supply chain, finance, customer service, etc.).

Based on our work and analysis of 30+ portfolios of US-based middle-market PE firms, typically, 20% to 40% of portfolio companies present an opportunity for a growth-oriented digital transformation.

When a growth-oriented digital transformation is applicable, usually, 70% to 80% of the EBITDA increase will be driven by organic revenue growth. In other cases, companies will present only a more limited opportunity like, for example, accelerating new customer acquisition or migrating IT to the cloud.

The next questions are how to identify the right opportunities and how to best organize execution.

How to identify the right opportunities

The portfolio companies suitable for a growth-oriented digital transformation are those that present both a market opportunity and a digital capability gap.

We engage with our clients only when together we can identify both a digital capability gap and a clear opportunity for value creation.

To be transparent, not all companies present a market opportunity that can be captured by enhancing their digital capabilities. Some companies, for example, operate in markets with only a few large potential customers where their manufacturing capabilities mostly drive organic growth (i.e., aerospace components manufacturing, specialty industrial chemicals, cosmetic products packaging, etc.). Others mainly depend on the development or acquisition of tangible assets (i.e., energy, infrastructure, and real estate) or need to improve their offering's competitiveness before focusing on accelerating organic growth.

Companies that present an upside market opportunity contingent on robust digital capabilities are, for example, those where a positive answer applies to two or more of the following questions:

- Does our B2B company currently operate in a nearly saturated large enterprises market but has an offering that would be appealing for smaller companies with none or just a few modifications?

- Does our B2B company cater to SMBs customers with a competitive products but currently only intercepts a small portion of the new opportunities available in the market each year?

- Does our B2C company's chance to accelerate organic growth depend on its ability to lower its current online customer acquisition cost (CAC)?

- Does our B2C company needs to increase store traffic into a number of recently opened locations?

- Does our company have an opportunity to accelerate organic growth by accelerating cross-selling of a substantial product portfolio or a smaller product portfolio offered to thousands of existing customers?

- Does our company have an opportunity to increase its wallet share with existing customers through greater engagement and better conversion?

- Can our company gain a competitive advantage, or close a competitive disadvantage, by developing digital touch-points providing greater convenience and utility to our customers?

- Does our company needs to enter new market segments or geographies leveraging a pure online or hybrid go-to-market approach?

Traditional market and competitive analysis are used to identify portfolio companies with a market opportunity to accelerate organic growth.

Portfolio companies that present a market opportunity contingent on robust digital capabilities have a competitive offering in at least some of the product or service categories in which they operate, face a fragmented market demand, or are dealing with an extensive product offering, or both.

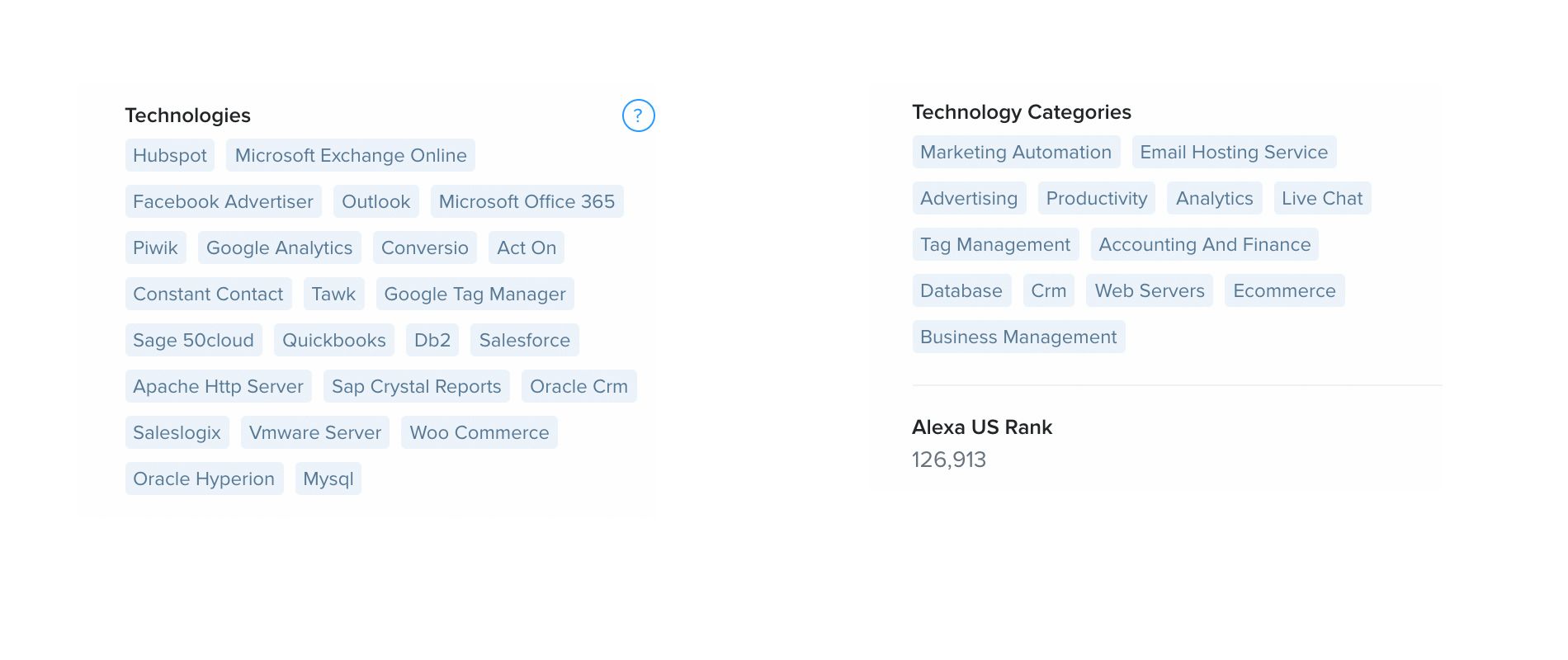

Once a market opportunity is identified, the next phase regards assessing a portfolio company's digital capabilities with a two-steps process. The first step is to look at the technologies adopted by a portfolio company using one or more technology intelligence tools (i.e., Clearbit and BuiltWith). Companies that have not yet adopted certain technologies are typically lacking the corresponding capabilities and processes.

The second step is to follow up with a few management interviews to develop a granular understanding of existing digital capability gaps. In an appendix at the end of this article, we have included a sample list of detailed relevant questions organized in six key areas:

- New customer acquisition.

- Customer lifetime value.

- E-commerce and customer service applications.

- Business intelligence (BI) and data analytics.

- Operational productivity.

- IT cloud migration.

A negative answer to one or more of those questions reveals an opportunity to strengthen digital capabilities to improve business performance and create a competitive advantage.

How to best organize execution

Having identified a few portfolio companies that could accelerate organic growth and value creation by strengthening their digital capabilities, the final step is to decide how to best organize for execution.

In the remainder of this article, we are going to discuss the four approaches that we commonly see:

- Attempting to hire a new digital executive.

- Retaining a major consulting firm.

- Engaging with smaller specialized vendors.

- Partnering with an interim digital transformation officer.

Attemping to hire a digital executive

For many portfolio companies, the default approach to start the digital transformation journey is to initiate a search for a new executive with digital expertise (i.e., a VP of E-commerce and Digital Marketing).

Unfortunately, the market for senior executives with general management and digital expertise is very tight and competitive, and even Fortune 1000 companies are often unable to find a suitable candidate.

For middle-market companies at the beginning of their digital journey, this search is even more difficult. The dedicated team and budget for the position are still small, the definition of success fuzzy, and the level of uncertainty very high. In the best cases, these searches take a very long time, and the recruited candidate is a young professional with great potential but a level of expertise too narrow for the challenge ahead. In the worst cases, the position is never filled.

Retaining a major consulting firm

Another common approach, especially at larger PE firms, is to retain a major management or technology consulting firm. Nowadays, all major firms have a well developed digital transformation practice staffed with brilliant professionals. However, often, this approach is also not a good fit for middle-market companies.

Major management consulting firms are usually excellent at identifying the right portfolio opportunities and developing digital transformation strategies. Often, the only downside is the high level of their fees. In recent years, many have also started to build internal execution capabilities. To reconcile a business model designed to serve Global 2000 corporations with the economic reality of middle-market companies, however, the proposed execution projects end up being too short in duration to produce a lasting impact. After a few months, when the consultants are gone, internal processes quickly regress to the initial state, and performance improvement rapidly fades away.

Major technology consulting firms also have business models designed to serve Global 2000 corporations. They often are a viable solution to develop digital products and solve complex technology problems, but are not engineered to help middle-market companies drive an acceleration in organic growth.

Engaging with smaller specialized vendors

A third approach is to engage with smaller specialized vendors directly. Nowadays, many excellent small specialized teams exist that can be a great partner for executives with digital expertise and know-how to orchestrate their work. However, most cover a very narrow specialty domain like digital paid advertising, search engine optimization, email marketing, B2B lead generation, CRM instrumentation, e-commerce development, data lake setup and maintenance, customer data platforms, BI and data analytics, and so on.

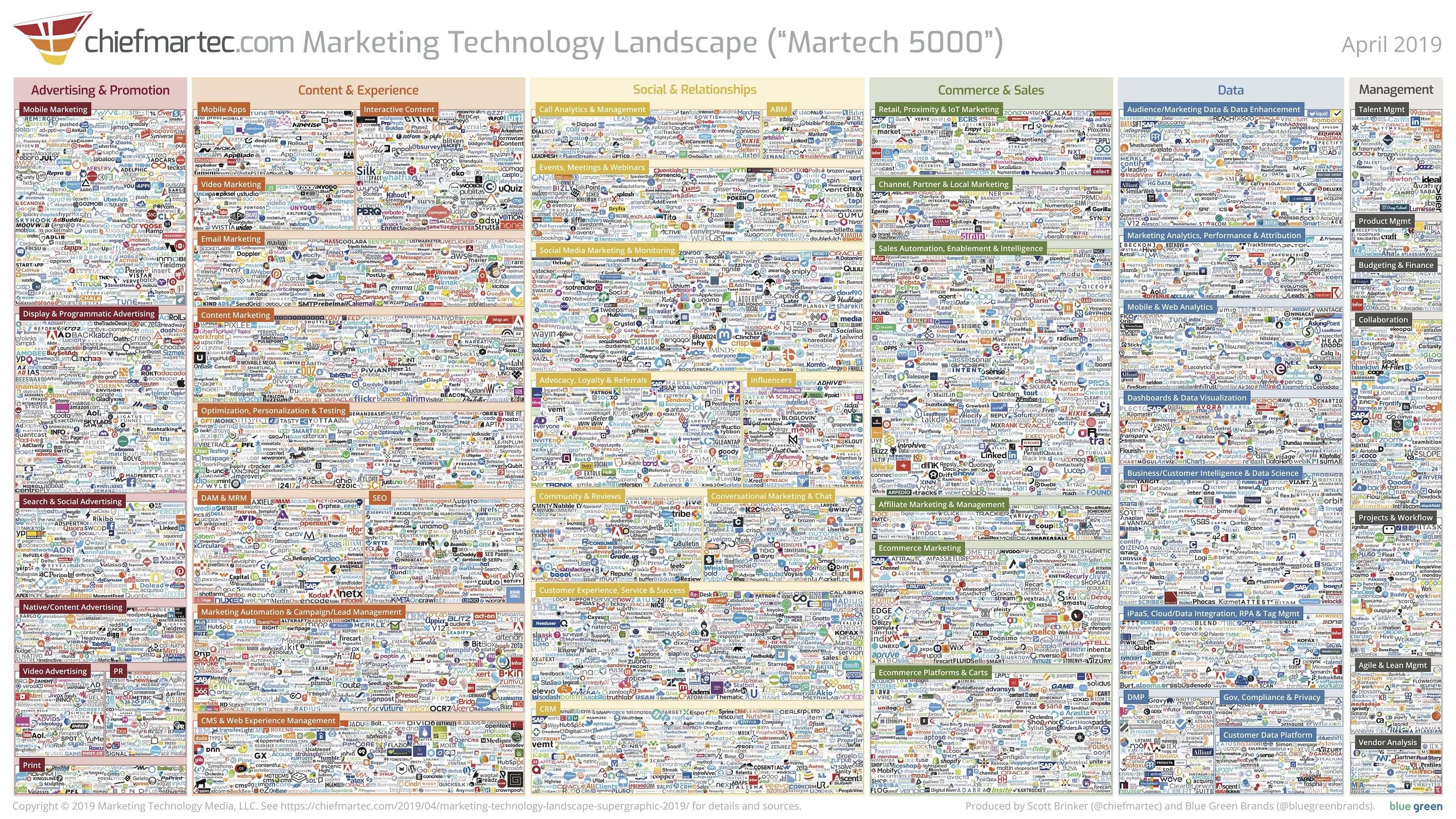

Many companies also specialize in specific technology tools: one firm might do email marketing using Pardot and another one using Marketo. One BI firm might specialize in Tableau implementations and another one in Power BI implementations. Before choosing a specialized consulting firm, therefore, a company needs to decide which technology tools to adopt. For a company lacking digital expertise this process can be overwhelming given the number of choices available in the market.

The chart below, for example, maps the landscape of marketing technology tools and lists 5,000 available products! (source: chiefmartec.com).

For the above reasons, this approach is also not recommended for middle-market companies without proper digital expertise.

Partnering with an interim digital transformation officer

Partnering with a fractional interim digital transformation officer is often the best choice for a middle-market portfolio company (Why every CEO needs a digital transformation officer). PE firms are also familiar with this engagement model and often refer to these executives as digital operating partners or advisors. Large PE firms might operate with affiliated executives, and smaller firms typically operate with independent executives.

To drive successful digital transformation programs at middle-market companies, these executives should share P&L and value creation responsibilities, be involved over a period of 18 to 36 months depending on the program scope, and have:

- A general management profile with prior business experience in leading cross-functional teams and managing P&L responsibilities, and a deep understanding of digital strategies, best practices, and technologies.

- A set of proven playbooks, refined over several years, used to drive organic growth and operational productivity at middle-market and early-stage technology companies where money and human capital are usually tight.

- A curated network of talented professionals covering a broad range of functional domains, including digital sales & marketing, design and content, data analytics, software engineering, and cloud services.

- A desire to work with an incentive system fully aligned with the portfolio company's executive team and the PE firm's partners.

Augeo Partners is a group of senior leaders with a passion and significant track record in driving organic growth and operational productivity through strategy, change management, and digital technologies, dedicated to partnering with middle-market PE firms and portfolio companies to accelerate organic growth and value creation. The time to start is now, and Augeo Partners can help.

Appendix: digital capability gaps sample questionnaire

Following is a sample list of detailed questions to help develop a granular understanding of existing digital capability gaps in six key areas. A negative answer to any question reveals an opportunity to improve business performance and create a competitive advantage.

New customer acquisition

- Has the company formalized a written definition of the ideal customer profile and the buyer personas?

- Does the company use a multi-touch revenue attribution model to properly account for the contribution of top and mid-funnel marketing campaigns and events?

- For B2B companies:

- Does the company use a sales intelligence tool to source accounts and key executives' contact information matching the ideal customer profile(s)?

- Does the company use a sales engagement platform to manage multi-channel outbound prospecting campaigns?

- Is the company website optimized for lead generation (i.e., has a clear articulation of the target audience and the offering benefits, has case studies and testimonials providing social proof, has forms to capture leads email addresses, etc.)?

- Does the company use a tool to discover the companies associated with its anonymous website visitors and to enrich the profile of its new leads?

- Does the company have a formal qualification process for new leads?

- Does the sales team use a CRM system to manage new leads and opportunities in a structured and consistent way?

- For B2C companies:

- Do non paid marketing campaigns (i.e., organic and direct traffic, email, social media, etc.) account for sixty percent or more of the online revenue from new customers?

- Does marketing use a systematic approach to prune out paid digital marketing campaigns with a low ROI?

- Is the company able to generate interest and engagement from new leads for a large portion of its online offering?

- Does the company e-commerce website perform well in terms of engagement and conversion of new visitors?

- Does the company use localized digital marketing campaigns to drive offline store traffic?

Customer lifetime value

- Does the company use a customer data platform to create 360-degree customer profiles, including all sales transactions and the most important interactions?

- Does the company use a customer analytics tool to identify opportunities or potential issues across time and behavioral cohorts?

- Does the company use a real-time customer segmentation application leveraging information about customer's identities and behaviors?

- Does the company use automated marketing campaigns to nudge customers toward desired behaviors and business goals (i.e., increase order frequency, increase cross-selling and upselling, reduce attrition, etc.)?

E-commerce and customer service applications

- Does the company have an e-commerce or customer portal application to provide greater convenience and utility to its customers?

- Are the digital touch-points aligned with UI/UX design best practices and easy to use?

- Is the e-commerce application able to price all catalog product orders for all types of customers (or are customers required to complete certain sales transaction offline)?

- Can the application provide a personalized experience based on a customer identity and its historical behavior?

- For more complex and high-ticket items, does the e-commerce application support an assisted sales workflow (with sales reps helping customers assemble their orders)?

- Are e-commerce prices and promotions always aligned with those used in other channels?

- Can customers use the e-commerce application or a customer service portal to have full visibility into orders' fulfillment and manage all post-sales activities?

- Does the content management system support easy and efficient workflows?

- Are the digital touch-points always available (i.e., 99.99% availability), and can they support spikes in traffic?

- Are the digital touch-point integrated with a customer data platform, a product analytics application, and a marketing automation tool to automatically monitor customers' usage and promote more significant adoption levels?

BI & data analytics

- Does the company have a cloud-based data lake or data warehouse collecting, organizing, and storing all data from relevant applications and systems?

- Has the company adopted a business intelligence (BI) application to produce and disseminate data reports and dashboards?

- Is the BI application powered by machine learning and natural language processing to improve the user experience and enable advanced functionalities like anomaly detection and forecasting?

- Has the company implemented the policies and processes required to ensure "data integrity" and promote data-driven decision-making across the organization?

- Are users across different departments satisfied with their access to data and data insights?

- When applicable, does the company use machine learning and other related technologies to power other more advanced data insights use cases (i.e., fraud detection, resource planning, preventive equipment maintenance, store traffic monitoring, etc.)?

Operational productivity

- Has the company adopted workflow automation and robotic process automation software to automate high-volume, business-rules-driven repeatable tasks and processes across all applicable functions (i.e., supply chain, customer service, accounting and finance, marketing and sales, etc.)?

- For manufacturing businesses, has the company adopted machine learning, computer vision, and IoT technologies to improve productivity in processes like product quality monitoring, preventive equipment maintenance, workers safety monitoring, industrial process bottleneck detection, etc.?

IT cloud migration

- Has the company started the migration of its on-premise IT infrastructure and application to the cloud?

- Has the company leveraged all opportunities to lower IT costs and improve operational agility by migrating IT infrastructure and applications to the cloud?