Is Portfolio Digital Transformation The New Driver Of Competitive Advantage In PE?

Yes, it is. This week, former co-head of Goldman Sachs Group Inc.'s merchant bank Sumit Rajpal made known he's launching a new private equity firm targeting companies sitting on valuable troves of data that can be used more effectively to spur growth and value creation. This announcement suggests two critical questions:

- Is leveraging digital transformation to accelerate growth and value creation at portfolio companies a strategy specific to a limited number of private equity firms, or is it a new driver of competitive advantage relevant for the private equity industry at large?

- And how can a private equity firm evaluate this strategy and, when appropriate, start its execution?

These are the questions we explore in this article.

This article is for you if:

- You're considering how best to foster productive conversations and pilot projects at your private equity firm.

- You're looking to identify the industry verticals where digital transformation is an important driver of value creation.

- You want to better understand how digital transformation can drive value creation at portfolio companies.

After reading this article, you'll walk away with a better understanding of:

- Six value creation drivers typically used in a digital transformation program to accelerate sustainable growth and value creation across several industries.

- Five specific challenges currently preventing many private equity firms from adopting digital transformation as a value creation strategy.

- Three pragmatic steps you can embrace to promote healthy conversations and to accelerate the adoption of digital transformation at portfolio companies.

Now is the right time for private equity to embrace the potential of digital transformation, data analytics, and AI. There has been incredible democratization of AI and digital capabilities over the past decade, and we believe that the time has come to use the power of these capabilities, in combination with deliberate investments in human capital, to drive growth and create sustainable value in portfolio companies. Sumit Rajpal, GrowthCurve Capital's Founder & CEO.

How digital transformation creates value

Digital transformation is a scorching topic nowadays. However, often the term means different things to different people. For some, it merely means migrating IT applications and infrastructure to the cloud. For others, it means developing an e-commerce website and investing in digital advertising.

For us at Augeo Partners, digital transformation means learning how to leverage modern data and software tools to achieve better business results. Specifically, we believe that management discussions about digital transformation should start from articulating the company's goals and opportunities in the following six business areas:

- Accelerating new customer acquisitions. In more and more industries (a list is included toward the end of this section), learning how to use data and software tools to optimize sales and marketing activities is becoming more critical. Increasing the volume of new leads, improving the conversion rate of new leads into actual customers, and reducing the average customer acquisition cost are the crucial dividends of a properly executed digital transformation program. In some cases, developing or joining an online marketplace might also be a valuable strategy to accelerate the acquisition of new customers or reduce the average customer acquisition cost.

- Increasing the customer lifetime value. Increasing cross-selling and up-selling, and reducing churn rate are often essential and challenging objectives at many portfolio companies, especially those pursuing add-on acquisition strategies. Relying exclusively on the sales team efforts and a monthly marketing newsletter is often not enough. Implementing a customer data platform to track customers' interactions across multiple channels and digital touchpoints, implementing personalized marketing automation campaigns, and managing structured sales pipelines are the required initiatives to better capture existing opportunities in today's highly competitive markets.

- Enriching the company's core value proposition. For many B2B and B2C companies, acquiring new customers and retaining existing ones depends on providing greater convenience and additional value-added services to their customers and distribution partners. Properly designed and managed e-commerce applications, customer service portals, and online marketplaces are the modern tools required to execute those strategies.

- Enhancing decision-making through better data insights. Data is the new oil and in most industries identifying new opportunities, spotting competitive threats early on, and optimizing business processes requires mastering data capabilities. To develop a competitive advantage, companies need to: 1) develop a data strategy; 2) learn how to use data lakes to capture, organize and store data at scale; 3) leverage business intelligence tools powered by machine learning and natural language processing technologies to generate better data insights and enhance decision making.

- Lifting operational productivity. Intelligently automating small repetitive tasks and eliminating paper documents in several operational processes (i.e., customer service, supply chain, finance, back-office administration, etc.) can be a meaningful opportunity to improve value creation at many companies. Knowing how to select and deploy the most appropriate tools for electronic form management, robotic process automation, and machine learning is key to unlock those opportunities.

- Improving IT agility and reducing IT costs. Finally, knowing how to gradually migrate on-premise infrastructure and applications to the cloud is a crucial strategy to gain operational agility and speed and to reduce IT spending over time.

In our experience, at least three of the above opportunities often exist at most companies operating in the following industries:

- Business Services.

- Consumer & Retail.

- Financial & Information Services.

- Healthcare.

- Manufacturing & Wholesale Distribution.

- Technology.

Companies can discuss the appropriate level of investment in a digital transformation program and the program priority in the context of their value creation plan only when the business goals and value creation opportunities have been adequately articulated. If, instead, the discussion is limited to some specific technologies and their associated expenses, in most cases the investment will always be too high, and now will never be the right time.

Achieving the value creation goals will mainly require organizational changes, new processes, new metrics linked to the management's incentive system, new human capital, and an agile and iterative approach to test, validate, and scale the new value creation strategies. For more considerations on identifying the right opportunities in your portfolio and how to best organize execution, you can read our previous dedicated article here.

Typical challenges and barriers to adoption

Fostering portfolio companies' digital transformation as a strategy to enhance value creation is a topic on the radar screen at most private equity firms. However, actual progress is often slow.

In this section, we explore five challenges and barriers that most firms encounter when trying to execute this strategy:

- There is no crisis. It is a common belief that crises are often needed to accelerate change. Despite 2020 was a challenging year because of COVID-19, business momentum has rapidly resumed, and most private equity firms and portfolio companies are doing just fine. In this context, having GPs agree on adopting digital transformation as a new value creation strategy and how to execute the strategy will require several adequately structured and informed discussions.

- GPs are extremely busy. Life at middle-market private equity firms is typically very busy. Managing LPs relations and fundraising activities, sourcing new deals, working on due diligence for add-on and new investments, and presiding over the firm internal affairs are only a few of the many essential activities demanding a lot of GPs' limited time. Nevertheless, before dedicating time to discuss digital opportunities at specific portfolio companies, GPs also need to form a strategic vision on why portfolio companies should embrace digital transformation as a value creation strategy and why the right time to act is now.

- Portfolio companies' CEOs are also extremely busy. Typically, portfolio CEOs are already very stretched implementing all the initiatives incorporated in the company's value creation plan. Also, they may often be uncomfortable with digital strategies as they have no prior experience in leveraging data and software to improve business performance. In that context, it is vital for investment and operating partners to promote adequately structured and informed discussions with their portfolio' CEOs on why they should consider accelerating their current value creation plan and the potential benefits and risks associated with such a move.

- Emphasis is on technology instead of value creation. The critical issues investment and operating partners should discuss with their portfolio companies' CEOs are if digital transformation could accelerate value creation and, in case, what the best way to execute would be. Unfortunately, we often see those discussions diverting their focus on narrowly defined technology issues and quickly lose momentum.

- Lack of expertise on complex digital issues in the operating team. When members of the operating team lack hands-on experience in leveraging data and software to execute value creation strategies, it is often complicated to connect digital transformation opportunities to dollars and cents. Therefore, it is pretty challenging to generate interest and commitment from investment partners and CEOs.

Pragmatic steps to move forward

Digital transformation programs, like any other change management program, are hard to execute successfully.

Studies show that in most organizations, two out of three transformation initiatives fail. The more things change, the more they stay the same. Harvard Business Review.

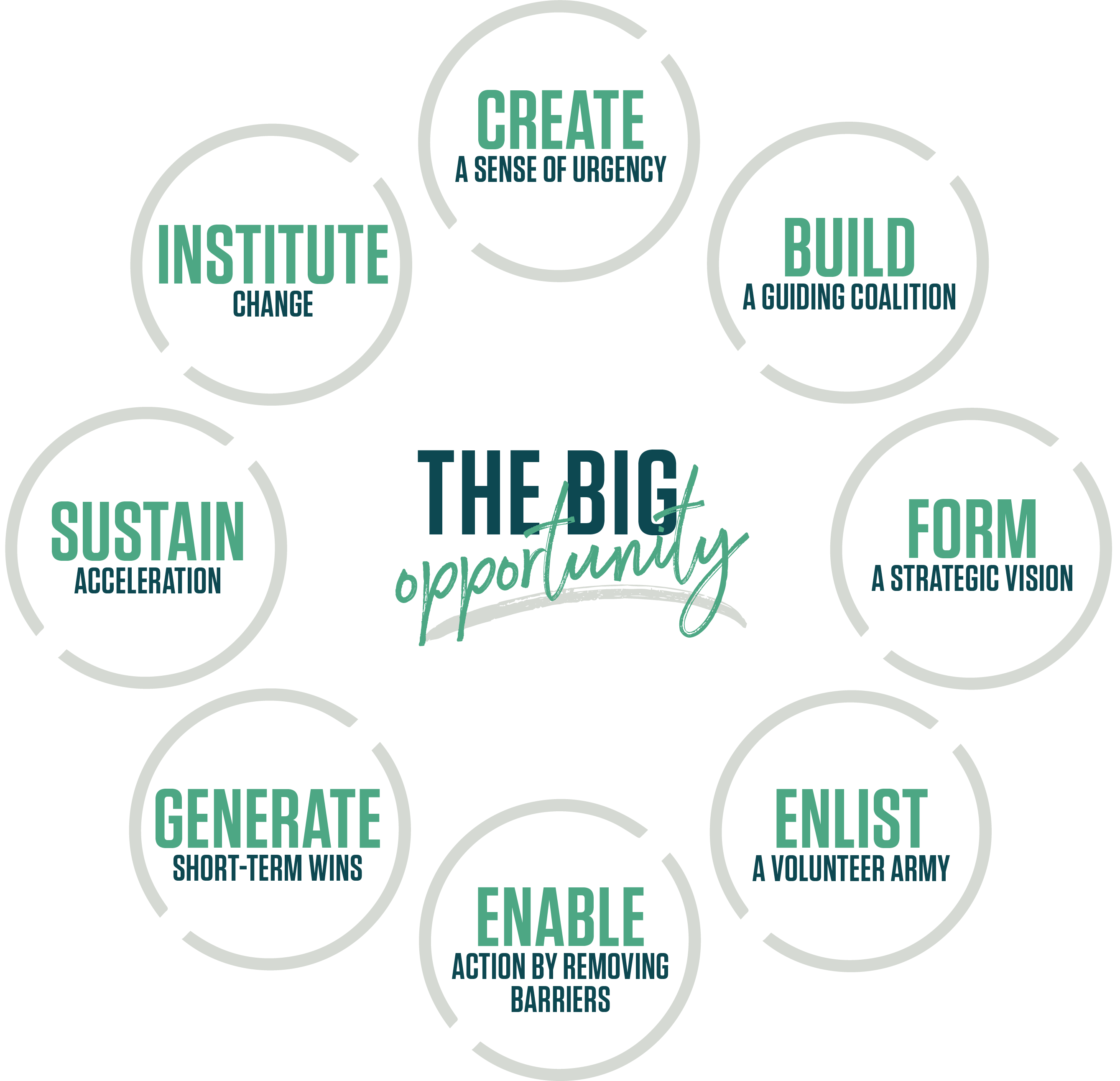

A recent search on Amazon.com for books on change management returned more than 50,000+ titles. However, Kotter's original framework on successfully leading change still provides a useful reference to identify pragmatic actions.

There are three pragmatic steps private equity firms should embrace to promote healthy conversations and, when appropriate, to accelerate the adoption of digital transformation as a portfolio value creation strategy:

- Stimulate a debate among investment and operating partners: communication and open discussions are critical in any change program. Distributing a short thought-starter among investment and operating partners and facilitating a couple of one-hour dedicated meetings could significantly help the partnership tackle essential questions such as:

- Is accelerating value creation at portfolio companies important to our firm?

- Do we believe that helping selected portfolio companies to execute digital transformation programs successfully would deliver a meaningful acceleration in value creation?

- How can we better educate ourselves about this value creation strategy and create a couple of pilot projects to learn and gain confidence?

- Disseminate a few thought-starters to your portfolio's CEOs: most portfolio' CEOs tend to resist adding a new initiative to the existing value creation plan, especially when they don't fully understand its risks/rewards profile and fear this will be yet another problem landing in their lap. CEOs and Board Members need to have a proper discussion about the proposed change's strategic rationale and its risks/rewards profile. A digital assessment outlining a before and after view for a few critical processes and capabilities will often be advantageous to support pragmatic and informed discussions. Usually, engaging in conversations with five to ten CEOs will help identify the one or two early adopters interested in piloting the new proposed approach.

- Embed a digital assessment in the due diligence process for a couple of new investments: sometimes, the best way to overcome the resistance to change is to embed the digital transformation program in the value creation plan from the very beginning. Working on new investments will also help develop new insights and generate short-term wins.

If you would like to discuss how Augeo Partners can help you execute the three steps outlined above, please schedule an initial call here.