Portfolio Companies' Digital Transformation in 2023: the What and How

The pace of digital transformation is accelerating across many industries, and the performance gap between digital winners and the rest is rapidly widening.

With more and more customers demanding better digital experiences in both B2C and B2B industries, a greater need for organic growth and operational productivity improvements, and normalization of supply chain operations, digital transformation is an increasingly important strategic priority for more and more private equity investors and management teams and 2023 is an excellent time to re-focus on this strategic goal.

Nowadays, companies that want to improve the performance of their core business processes can leverage a wide variety of new, easy-to-use, and affordable data and software technologies.

Digital transformation, therefore, is primarily a management challenge that requires selecting the most appropriate business goals, making technology choices, recruiting digital partners and talent, and managing the organization's natural resistance to change.

Leveraging data and software technologies to gain a competitive advantage and improve operational performance is becoming increasingly essential across most industries.

This article will cover:

- A summary of why digital transformation is both a strategic imperative and a challenge for most middle-market companies.

- The role of the Board of Directors in developing an intentional change management strategy aligned with the organization's culture and values.

- The main components of a digital transformation program, based on our work with middle-market portfolio companies.

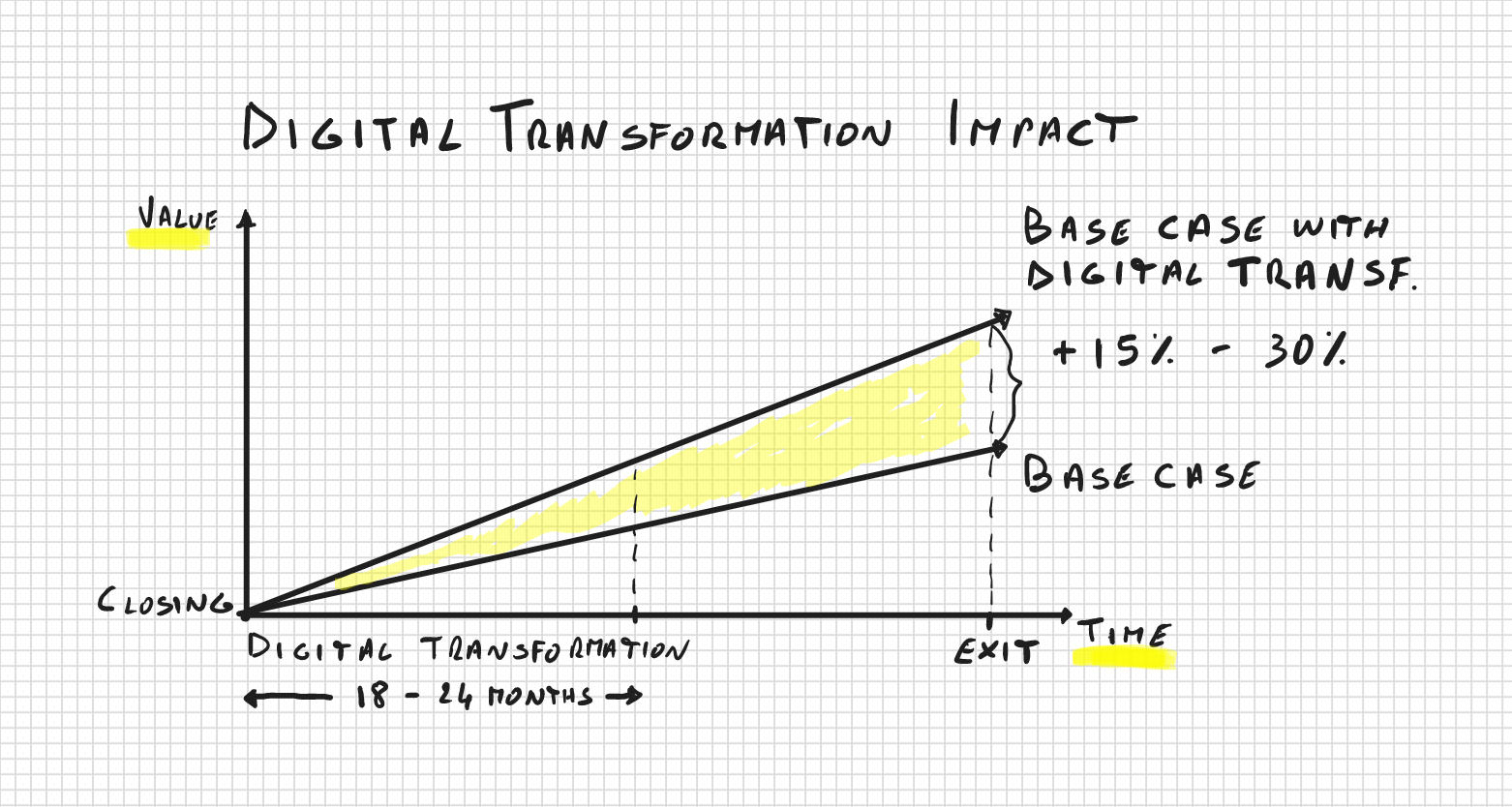

- Our recommended approach for implementing a digital transformation program at middle-market portfolio companies in 18 to 24 months.

The reasons why for digital transformation

Digital transformation is yet another form of business change affecting companies worldwide that started with technology companies, then impacted large enterprises in all kinds of industries (i.e., Fortune 1,000 companies), and is now becoming an imperative for success at more and more middle-market companies.

What triggered the change has been the enormous investments that large technology companies and the venture capital industry poured into software and data technologies over the last fifteen years. These resulted in a proliferation of new easy-to-use and affordable data and software tools that can be leveraged to improve core business processes.

When used correctly, these new software tools, combined with new business best practices, can yield significant improvements in the effectiveness and efficiency of core business processes like, for example, customer acquisition, cross-selling and up-selling, customer support, service or product delivery, manufacturing, data and predictive analytics, forecasting, customer profitability and financial reporting.

The challenge for many middle-market companies is learning how to adopt those technologies to improve business performance by accelerating organic revenue growth and improving operational productivity.

Finally, with the most recent acceleration of investments and achievements in data and AI&ML technologies, it is reasonable to predict that mastering how to create valuable and proprietary data sets and leverage third-party AI&ML technologies to reduce costs and improve the customer experience will become an essential source of a competitive moat in several industries.

The digital transformation of middle-market companies is a proven strategy to accelerate value creation and it is primarily a managerial challenge. It requires selecting the most appropriate business goals, navigating countless technology choices, recruiting digital partners and talent, and driving organizational change affecting core business processes and people at all levels.

Private equity investors can play an essential role in helping management teams tackle those challenges and mastering how to facilitate the digital transformation of portfolio companies is becoming a critical source of competitive advantage to achieve top-quartile performance.

Private equity investors focusing on repeatable alpha generation should make digital transformation a standardized component of their value creation strategy, with a set of proven and repeatable workstreams driven by experienced partners and a clear, logical decision tree guiding choices regarding when and how to deploy them (for a deeper discussion on the renewed emphasis on alpha generation in private equity see Bain & Company, p. 55, Goldman Sachs, and PwC, ).

This article aims to provide an initial reference template to stimulate thoughtful and productive conversations.

The essential role of the Board of Directors

Digital transformation is a management challenge and the Board of Directors plays a critical role in driving its successful execution by actively promoting organizational alignment through ongoing communication and open discussions. As any change program, digital transformation can have significant cultural and organizational implications and will often face some kind of internal resistance.

The role of the Board is essential to ensure alignment with the company's strategic intent, foster a culture of innovation, and help resolve internal disagreements and hesitations that commonly arise during critical change programs.

Other key responsibilities of the Board in digital transformation include:

- Providing strategic direction and oversight: The Board should set the overall direction and goals for the program, ensure ongoing support, recognize significant contributors, accept failures, and maintain momentum.

- Approving the budget and resource allocation: Digital transformation programs require adequate investment and resource allocation, and therefore the Board ongoing support and endorsement to avoid de-funding of critical initiatives.

- Evaluating risk and ensuring compliance: Digital transformation programs can introduce new risks and compliance requirements (i.e., data privacy, cybersecurity, etc.). Assessing these risks and ensuring appropriate measures are in place to mitigate them are also essential areas for the Board contribution.

- Monitoring progress and results: The Board should regularly monitor the progress of the digital transformation program and assess its impact on the business and the organization by tracking key performance indicators (KPIs) and other metrics, reviewing progress reports from management, and facilitating ongoing discussions to overcome hesitations and resistance to change.

In summary, the Board of Directors plays an essential role in ensuring that the digital transformation aligns with the organization's overall strategy and natural resistance to change is appropriately managed.

Overcoming the "not invented here" (NIH) syndrome will often be a significant challenge facing the Board of Directors, requiring a concerted effort to create a culture of collaboration and innovation among the team at the top. Leading by example, private equity investors and top management teams will break down barriers and create an environment more conducive to creativity, innovation, and problem-solving.

The main components of digital transformation

To capture existing value creation opportunities, digital transformation at middle-market companies will typically leverage a set of proven playbooks appropriately tailored to a company's specific situation and needs. Except for account-based outbound prospecting, all the other main work streams outlined below apply to both B2B and B2C companies.

1. Designing and deploying a customer data platform (CDP)

Leveraging data to make better managerial decisions, optimize operational processes, and deliver greater customer value is an essential priority at many businesses.

Often, however, only some of the valuable business data is adequately captured and processed, and access to the available data is challenging for both internal and external users.

A customer data platform (CDP) is a type of software designed to collect, integrate, and manage customer data from various sources, such as website applications, social media, advertising platforms, email, transactional systems, and more. The goal of a CDP is to create a unified customer profile used to deliver personalized, relevant experiences to customers across all channels and touchpoints.

Deciding what data to collect and process to support managerial decisions better, optimize operational processes, and provide value to customers is a crucial strategic aspect when designing and deploying a CDP.

The data collected by a CDP is often organized into a centralized database that allows marketers and other stakeholders to analyze and activate the data in real-time. This helps organizations better understand their customers, identify patterns and trends, optimize their marketing and sales efforts, and intelligently automate other operational activities.

Organizations can use a CDP to improve customer engagement, increase conversion rates, enhance cross-selling and up-selling activities, automate certain post-sales activities, and enhance overall customer satisfaction. As such, a CDP is a foundational investment in any digital transformation.

We often integrate the deployment of a CDP with a data lake or data warehouse and a business intelligence (BI) solution to provide permanent storage for all the business data and facilitate the distribution of reports, KPIs, and dashboards to both internal and external users. Our recommended CDPs in 2023 are RudderStack and Segment.

2. Designing and implementing advanced data strategies

Once a basic data solution is in place (i.e., a CDP and a BI platform), businesses often want to pursue further opportunities to improve performance across specific functional domains and deliver new value-added services to customers.

A typical way distributors can use data to deliver value to their upstream manufacturing partners, for example, is by providing them with access to historical and predictive sell-out data aggregated at the ZIP or CBSA level.

The amount and variety of valuable data that is available to businesses continue to grow exponentially and span three broad categories:

- Transactional data generated by IT systems (i.e., Financial Planning and HR Systems, ERPs, CRMs, Marketing Automation Platforms, etc.).

- Structure and unstructured data generated by customers (i.e., customer service messages, surveys' responses, product reviews, social media posts, etc.).

- Real-time streaming data generated by digital touch points and IoT devices (i.e., events data generated by web and mobile applications, video feeds generated by video cameras, data generated by industrial sensors and other IoT devices, etc.).

However, the traditional tools that many companies still use to generate and consume data, like spreadsheets and basic BI tools, are labor-intensive, not responsive enough, prone to errors, and limited in the value they can provide.

New affordable and easy-to-use data analytics platforms powered by ML and NLP technologies are nowadays available to generate better data insights, create value-added services for customers, and leverage predictive analytics to enhance business processes like providing relevant product recommendations to customers, improving demand forecasting and inventory optimization, and optimizing manufacturing processes.

Many of the cloud solutions available in the market today (i.e., Algolia, Amazon Forecast, Amazon Lookout for Equipment, Amazon QuickSight, Simfoni, Vanti, etc.) leverage the following data analitics capabilities powered by ML and NLP technologies:

| Capability | Description |

|---|---|

| Auto-narratives | Automated production of data summaries and insights in plain language. |

| Natural Language Queries | Automated creation of answers (i.e., numbers, charts, and tables) to business questions asked in plain language. |

| ML Anomaly Detection | Automated uncovering of hidden insights by continuosly analyzing large volumes of detailed business metric data. |

| ML Forecasting & Predictive Analytics | Predicting key business outcomes and metrics and performing what-if analysis with point-and-click simplicity leveraging ML-powered forecasting algorithms. |

Finally, with the latest arrival of generative AI technologies, more tools powering new uses cases will emerge in the following three to five years and the importance of industry specific and proprietary data sets will continue to increase. The time to define and start collecting those data sets is now.

Prior and more in-depth articles on machine learning and data insights can be found here and here.

3. Developing or re-factoring e-commerce, marketplace and customer portal applications

Offering well-designed and easy-to-use customer digital touchpoints to provide greater convinience to existing customers or to expand into new markets is nowadays essential for many B2C and B2B businesses. Containing the development and maintenance costs of those digital touchpoint is a significant challenge for most companies.

In many of our projects, we find that companies underinvest in data solutions and overinvest in poorly performing custom software applications to deliver functionalities that are not specific to their business domain.

Typically, middle-market companies either lack essential digital touchpoints or have applications that are difficult to use and very expensive to maintain due to a poor technology strategy and wrong technology architectural choices. This is why in many cases a crucial component of our digital initiatives is developing or re-factoring e-commerce, marketplace, and customer portal applications.

To provide a frictionless customer experience and develop applications that are less expensive to develop and maintain, we focus on understanding end-to-end business requirements and building technology applications adopting a composable, truly open, future-proof, and best-of-breed MACH technology architecture (i.e., microservices-based, API-first, cloud-native and SaaS, and headless).

By adopting a cloud-based composable technology architecture, we can reduce time-to-market and development costs by 30% to 50% and maintenance costs by 50% or more.

Composable architecture refers to a technology architecture pattern that allows for maximizing the different configurations of technology solutions by mandating that each component in the system have standardized interfaces, namely APIs. At its core, a composable architecture treats technology resources as interchangeable building blocks that are quickly and easily assembled to meet the specific needs of a given software application. Custom software for functionalities that are not domain specific (i.e., user identity management, e-commerce, search and product recommendations, scheduling, etc.) is replaced with proven third-party commercial or open-source APIs and UI components like, for example, AWS Cognito, adyen, Algolia, BigCommerce, Commercetools, Constructor, hygraph, OnSched, Supabase, Talon.one, VueStorefront, and TailwindUI.

One of the key advantages of a composable architecture is that it can help organizations reduce costs, increase efficiency and agility, avoid vendor lock-in, and accelerate time-to-market by allowing them to use resources more effectively and avoid wasting resources on unnecessary custom software developments that are not specific to their business domain.

4. Implementing B2B account-based outbound prospecting

Accelerating organic new customer acquisition is an essential driver of value creation for B2B businesses across many industries (i.e., manufacturing, distribution, services, SaaS, etc.).

However, accelerating new customer acquisition is often challenging for many B2B companies as it requires a deep understanding of the target market, identifying potential new customers, and developing effective processes to reach them.

For companies with a relatively large addressable market (i.e., a few thousand prospects or more), account-based outbound prospecting is the most effective way to get in front of more new prospects (i.e., potential new buyers with a good fit) to generate new sales opportunities. This frontend sales process leverages:

- External databases to identify accounts and contacts matching the ideal customer profile and persona, source company and contact information, and research other data required to craft personalized messages.

- Structured sequences of outreach activities (i.e., emails, calls, voicemails, social media messages, etc.) to ensure persistency, consistency, and outcome predictability.

- Templated messaging and other carefully crafted content (i.e., personalized email and voicemail templates, case studies, etc.) to generate high levels of curiosity, interest, and engagement.

- Specialization of roles to increase productivity and cost-effectiveness, with younger Sales Development Reps focusing on outreach activities and initial discovery calls and more experienced Account Executives concentrating on managing the new sales opportunities generated by the frontend process.

- A modern sales technology stack (i.e., sales intelligence tools, workflow automation tool, CRM, sales engagement platform, etc.) to maximize consistency, productivity, cost-effectiveness, learning, and ongoing process optimization.

Given the typical high ROI, helping B2B portfolio companies adopt a structured, data-driven, and technology-enabled prospecting process to accelerate new customer acquisition should be a key priority for all middle-market private equity firms in 2023 and beyond.

Our recommended sales technology stack for middle-market companies in 2023 includes ZoomInfo, Pipedrive, Outplay or Klenty, Hippo Video or Vidyard. For a more in-depth discussion of this topic, see our recent article on Accelerating B2B Customer Acquisition in 2023.

5. Optimizing inbound lead generation activities

For companies targeting consumers or small and medium size businesses, optimizing inbound lead generation and customer acquisition is often a critical yet challenging lever to accelerate organic revenue growth.

Nowadays, economists claim that we live in an attention economy where the attention of consumers and business customers is the scarse resource. In other words, it is the idea that in the digital age the ability to capture and hold people's attention is becoming increasingly valuable and challenging.

There is a finite amount of attention that people can give and capturing that attention is a crucial driver of value creation. Companies that can attract and retain people's attention can monetize that attention through traditional and e-commerce transactions, subscriptions, or other forms of revenue.

At middle-market companies, we often encounter situations where the business is either under-investing in these activities or unable to achieve a positive return on the investment.

At a B2B SaaS company with an annual investment in paid media of several million dollars, for example, we were able to reduce spending by about 30% with no negative impact on customer acquisition. At another distributor with no prior experience in paid media, over nine months we were able to rump up paid media monthly spending to about $75,000 achieving a CLTV / CAC ratio equal to 3.3 (customer life time value / customer acquisition cost).

Typically, what the goal is in terms of customer acquisition cost (CAC) is not adequately articulated, a comprehensive action plan is not available, the measures used to establish success are inadequate (i.e., vanity metrics like impressions, clicks, and click-through rates), and a rigorous process for market testing is lacking. Helping portfolio companies to develop and execute a proper inbound leads generation strategy and action plan can yield significant returns or, at least, stop wasting significant financial resources.

A practical action plan should define the target audience, conduct keywords research and determine a keywords strategy, create a marketing content plan, optimize the marketing website for search engines and conversions, leverage paid media campaigns, build an email list of qualified leads for re-targeting, define proper metrics (i.e., volume of qualified leads, top funnel conversion rate, bottom funnel conversion rate, etc.) and measure results (leveraging a CDP or another suitable tool).

With a proper action plan in place, a sensible investment, and rigorous market testing over six to nine months, companies can establish if inbound lead generation and customer acquisition can be a scalable strategy to accelerate organic revenue growth. Also, the process usually help identify opportunities for further improvements in the product/market fit.

6. Automating customer engagement processes

Once a good volume of leads and customers are in place, the next goal is to increase the percentage of leads converted into customers and the customer lifetime value. Here we often find CEOs with well-defined strategies who could be more satisfied with their marketing and sales team's ability to execute those strategies consistently and at scale.

Leveraging a modern customer engagement platform to automate marketing and sales processes is nowadays essential to implement an efficient and effective go-to-market strategy and achieve common business goals like qualifying leads, increasing conversion rates, improving cross-selling and upselling, and reducing customer attrition. Over a period of 6 to 9 months, well designed and implemented customer engagement processes can typically drive a lift of at least 10% to 20% in customer acquisition and cross-selling.

Other critical success factors include developing quality content that is engaging, informative, and valuable; personalizing the customer experience to tailor content to individual preferences and different stages in the customer's journey; promoting a culture of innovation, as well as a willingness to experiment and take risks; and creating frictionless and engaging user experiences across multiple channels and touchpoints through ease of use, speed, reliability, and accessibility.

Moving from one-to-one manual ad-hoc sales activities to structured and well-orchestrated nurturing and engagement sales processes to surface the most significant opportunities can result in a considerable acceleration in organic revenue growth.

Our recommended customer engagement platform for B2C and B2B businesses is Customer.io. The platform offers powerful yet easy-to-use functionalities supporting basic and advanced use cases, it is reasonably priced, and the company offers the best customer support in the industry.

7. Improving the customer experience further

Constantly improving the customer experience and becoming a customer-centric company is another essential priority for many CEOs. Research shows that customer-centric companies are 60% more profitable than companies that do not make decisions with a customer focus.

Creating a genuinely customer-centric business takes real work, time, and resources. However, our work often finds opportunities to meet critical CEOs' goals regarding improving the customer experience that require modest investments and are quick to implement. The followings are our top three initiatives to improve the customer experience while also improving internal productivity:

- Adopting a help desk platform. Several tools exist today to help businesses publish self-help articles and efficiently manage customer conversations through shared mailboxes (i.e., support@yourcompany.com) and other channels. These tools provide essential functionalities like content editing and publishing, templated replies, workflow automation, tagging, and reporting. Leading platforms include Help Scout (our recommended solution), Intercom, and Zendesk. For most middle-market companies, the monthly cost of using one of these platforms ranges from a few hundred dollars to a couple of thousand dollars.

- Providing customers with online access to reports and dashboards. Distributing information to customers regularly is an important goal at many companies. This usually entails manually generating monthly reports, emailing them to clients, and spending a significant amount of hours addressing follow up questions. When the data is already stored in a central repository (i.e., a data warehouse or a data lake), by adopting a modern BI tool with row-level security, most middle-market companies can provide their customers with online access to reports and dashboards with advanced drill-down functionalities in a matter of weeks, and at a monthly cost ranging from a few hundred dollars to a couple of thousand dollars. Affordable and easy-to-use platforms to enable this use case includes Metabase and Amazon QuickSight.

- Allowing customers to access and pay their invoices online. With remote working becoming increasingly popular and permanent, many B2B customers are asking to access and pay their invoices online. Usually, this functionality is not provided by most ERP systems. However, with an upfront investment of a few thousand dollars and a cost of about $0.25 per paid invoice through ACH, companies can integrate their ERP with a specialized platform that will provide customers with online access to all their invoices and the ability to pay those invoices via ACH or credit card (when the company enables this option). For this use case, our recommended platform is Bill.com. The same platform can also help increase internal productivity in AR processes.

8. Capturing other operational efficiences

There are several other opportunities to leverage data and software technologies to capture operational efficiencies that are industry or company-specific. In this last section, we are going to mention three examples that we often find at manufacturers, distributors, and providers of healthcare services:

- Digitizing paper forms.

- Adopting an RPA platform to ingest paper documents.

- Avoiding costly and time-consuming ERP system migrations.

Digitizing paper forms

Collecting information from internal and external users is critical in many processes across several functional domains (i.e., sales, supply chain, accounting, finance, etc.). Many companies still use paper forms that need to be collected, routed across different functions, and entered into some IT systems to generate analyses and reports.

A better way to address this need is to adopt a no-code SaaS application to manage electronic forms, automate workflows and the collection of signatures, and automatically integrate the data collected with other systems, applications, and reporting tools. Adopting one of the many available solutions across the organization often results in significant savings, fewer process delays, and a better experience for internal and external users.

Our recommended platform in 2023 for this use case is Formstack. This well-designed and robust solution is affordable and easy to adopt, integrates with hundreds of other popular web applications, and offers high security and compliance (i.e., HIPAA, PCI, GDPR, and WCAG).

Adopting an RPA platform to ingest paper documents

Ingesting information received from third parties through manual data entry is another typical challenge for many companies. It can drive material costs and usually result in significant data omissions and errors that negatively impact core business processes, cause delays, and decrease the productivity of internal and external users.

Robotic process automation (RPA) is a software technology that makes it easy to build, deploy, and manage software robots that emulate human actions interacting with digital systems and software. Like people, software robots can understand what's on a screen, complete the correct keystrokes, navigate systems, identify and extract data, and perform a wide range of defined actions. But software robots can do it faster and more consistently than people, eliminating low-value activities and data entry errors.

RPA streamlines workflows, which makes organizations more profitable, flexible, and responsive. It also eliminates data entry errors and increases employee satisfaction, engagement, and productivity by removing mundane tasks from their workdays.

Our recommended solution for this use case in 2023 is UIPath. However, other vendors like IBM, Microsoft, and SAP also offer similar solutions.

Avoiding costly and time-consuming ERP system migrations

Although modern ERP systems are a mature technology that has been in the market for about 30 years, many companies still spend too much time and money to deploy these ERP systems and are often unable to achieve a proper return on investment for varios reasons, including a poor selection of the system integrator responsible for the implementation and an inadequate definition of the business requirements.

Most of today's leading ERP vendors offer solutions with equivalent functionalities and capabilities. Migrating from one system to another will often absorb a lot of time and financial resources without providing any material benefit to the business.

Whenever possible, we prefer to look into ad-hoc data solutions and SaaS applications to address unmet business requirements while avoiding an ERP system migration. When this is possible, the savings are material.

While it is often the case that companies using an ERP system face some problems related to its implementation, it is also true in our experience that companies can launch a digital transformation program that will accelerate value creation while, at the same time, fixing their ERP system issues.

Digital transformation's typical phases and timeline

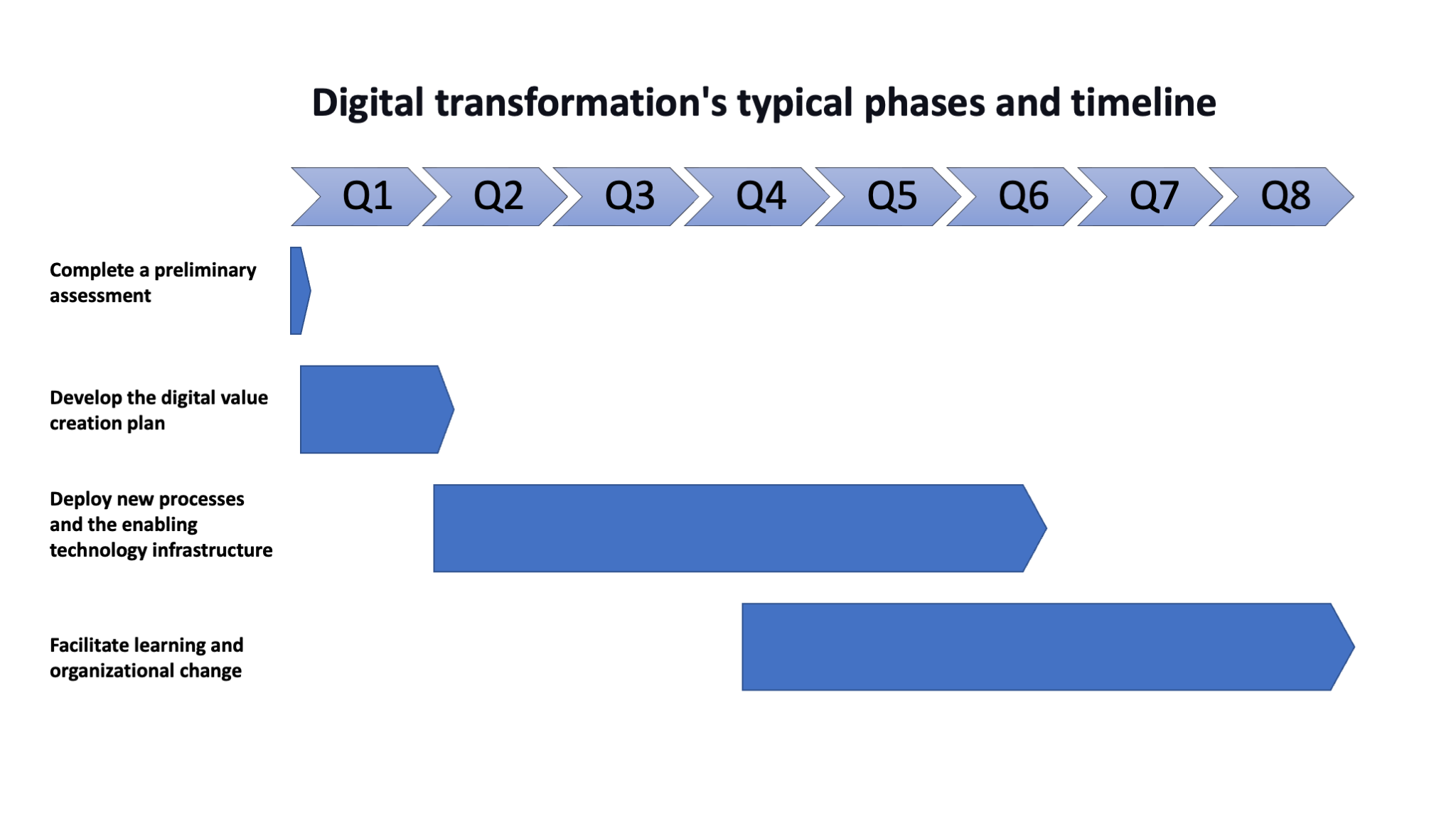

Our digital transformation programs tipically span between 18 and 24 months and are articulated in the following four phases:

- Completing a preliminary assessment.

- Developing the digital value creation plan.

- Deploying new processes aligned with best practises and enabled by data and software technologies.

- Managing and facilitating organizational change.

Completing a preliminary assessment

We engage with our clients only when together we can identify both a digital capability gap and a clear opportunity for value creation. This is why at the beginning of each engagement we spend a few days interviewing the private equity investors and the management team to learn about strategy and goals, assess current processes and digital capabilities, and formulate initial hypotheses on how a digital transformation program could help the company accelerate value creation.

We move forward only when together we have developed a positive high-level investment case.

A detailed discussion on how to identify the right opportunities among portfolio companies can be found in a prior article here.

Developing the digital value creation plan

The next phase of work, typically lasting between 3 to 4 months, is about developing a more detailed digital value creation plan. Working side-by-side with the management team and the private equity investors, during this phase of work we typically focus on the following activities:

- Completing a more detailed assessment regarding current processes, policies, internal capabilities, and existing technologies.

- Articulating the top-down goals regarding revenue acceleration and operational productivity improvements at a more granular level, and developing a greater confidence level in the investment case.

- Defining the required new processes and enabling data and software technologies, determining training and hiring needs, and estimating other financial requirements.

- Developing a work plan and budget, prioritizing the various initiatives, and creating an implementation team with both internal resources and external partners.

Adopting an agile approach focusing on goals, requirements, and constraints to develop clear charters for the implementation teams is essential to completing a comprehensive plan within the given timeframe.

Deploying new processes enabled by data and software technologies

The implementation phase is an exciting time during which we focus on designing the new processes, deploying the new data and software technologies, and completing other required activities (i.e., clarifying how to qualify new leads, developing new marketing content and sales collateral materials to engage new prospects and existing customers, adjusting pricing and terms when required, codifying institutional knowledge regarding internal processes and operations, etc.).

Key strategies to maintain momentum and excitement during this phase include generating small wins (i.e., solving minor problems) each month or every other month, initiating small market tests regarding the new marketing and sales strategies to collect data, identifying adjustments when appropriate, and gradually build confidence in the new strategy, and continuously recognizing contributions and small achievements.

The more significant impact on value creation will build over time, but it is the celebration of the small wins that will allow the program to maintain momentum and scale in due time.

Managing organizational change

Managing organizational change can be complex, it requires time, and there is no one-size-fits-all approach. To achieve the desired value-creation results, people at all levels of the organization will need to complement their industry expertise with data-based insights when making decisions and gradually learn how to orchestrate more automated and structured processes to improve productivity and accelerate execution.

Changing people's behavior is the digital transformation's most significant challenge requiring leadership, mentoring, training, and a learn-by-doing approach. Selecting and deploying new technologies is the easy part!

In our experience, the most effective way to capture the value creation potential of digital transformation is to develop and implement an intentional change management strategy pairing the internal management team with experienced digital business and technology leaders over a few quarters to jointly solve problems, experiment and innovate, and learn how to leverage best practices and new technologies to improve business effectiveness and efficiency.

Most people are uncomfortable with change, and most organizations naturally resist change. That is why digital transformation is not a technology initiative but a managerial challenge, and the role of the Board of Directors is essential for success.

Augeo Partners is a boutique firm of senior leaders with a passion and significant track record in driving organic revenue growth and operational productivity through strategy, digital processes and technologies, and change management. We partner with private equity investors and management teams to accelerate value creation through a set of proven strategies and repeatable playbooks. The time to leverage business best practices and digital technologies to accelerate value creation is now, and Augeo Partners can help.