Accelerating B2B Customer Acquisition in 2023

Accelerating organic new customer acquisition is an essential driver of value creation for B2B businesses across many industries (i.e., manufacturing, distribution, services, SaaS, etc.). However, accelerating new customer acquisition is often challenging for many B2B businesses. It requires a deep understanding of the target market, the ability to identify potential customers, and the ability to develop effective processes to reach them. Additionally, it can be difficult to differentiate from competitors and to build trust with potential customers. However, with the right go-to-market strategies and resources, accelerating B2B new customer acquisition can be successful.

Helping B2B portfolio companies adopt a structured, data-driven, and technology-enabled prospecting process to accelerate new customer acquisition should be a key priority for all middle-market private equity firms in 2023 and beyond.

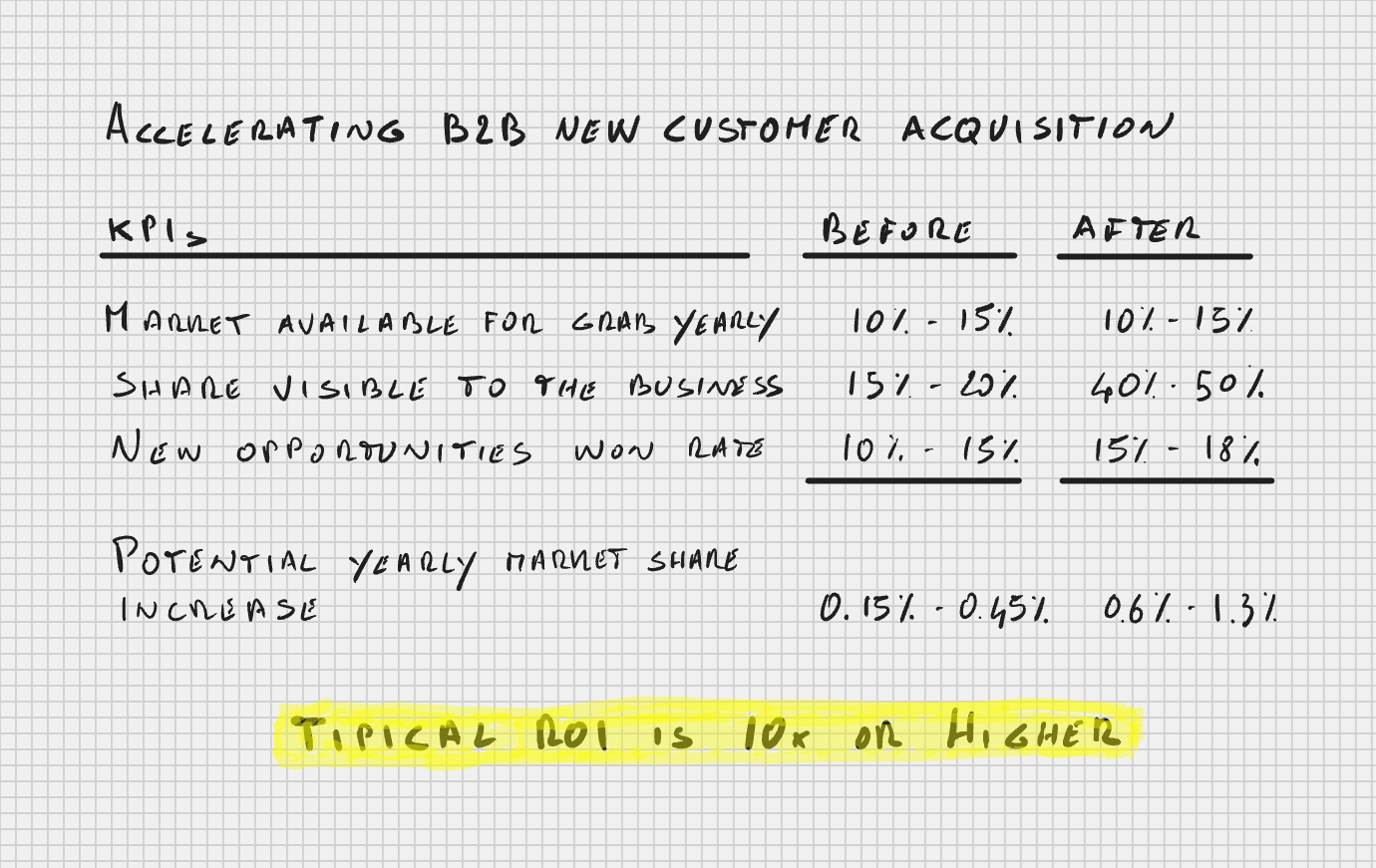

Developing a repeatable playbook and consistently making it a standard component of the value creation plan for B2B portfolio companies will produce the highest ROI (typically, 10x or higher).

In the past, we wrote extensively on this topic in "The ultimate CEO guide to leveraging a CRM project to increase revenue and "Leveraging B2B outbound prospecting to accelerate organic growth".

This article, therefore, will only cover some key aspects and new learnings resulting from our work in 2021 and 2022.

Assessing the current situation

Assessing historical results regarding organic growth and the state of the B2B new customer acquisition process is a common element of the work we do with B2B portfolio companies during the development of their value creation plan. Across different companies operating in various industries, those assessments often reveal the following common picture:

- The organic growth rate is low or average, and new organic business mainly comes from a share of wallet expansion at existing accounts. Yearly gains in market share are minimal, and sometimes negative, especially when the largest existing customers are losing market share to new market entrants or other existing businesses.

- The amount of total business that is available for grab each year is limited (i.e., 10% to 15% of the total market) and driven by a few contingent events like large accounts replacing an existing supplier due to product or service issues or smaller businesses entering the market or rapidly expanding their market share.

- The relatively small sales team, relying primarily on their industry network, referrals from existing customers, and inbound new opportunities, can intercept only a small share of the new business available each year (i.e., 15% to 20%).

- The bottom of the sales funnel (i.e., the new opportunity management process) is working relatively well with a few options for further improvement (i.e., process standardization, better communication materials, improved terms and conditions, etc.).

In the above situations, the main lever to accelerate B2B new customer acquisition is deploying a structured outbound prospecting process to increase the volume of new opportunities entering the sales funnel. A properly developed business case will reveal clear KPIs and the potential for a significant ROI.

What is often very important to clarify to minimize resistance to change is that the new strategy should complement, and not replace, the existing valuable sources of new business opportunities (i.e., referrals from industry contacts and existing customers, and new inbound leads).

On the other hand, when the new opportunities won rate is below 10%, before building a new structured outbound prospecting process to accelerate customer acquisition, management should first improve the business product/market fit (i.e., improving terms and conditions, pricing, the product or service features, etc.).

Deploying a structured prospecting process

To pursue the above strategy, we typically design and execute a project articulated in five phases spanning between 8 to 10 months in total depending on the size of the portfolio company and the length of its selling cycle.

1. Identifying the target market and potential new customers

This first step is a critical phase of work, typically lasting three to four weeks, aimed at clarifying a vital element of the go-to-market strategy. In fact, building an effective and efficient sales process will only be possible when prospecting appropriately qualified potential new customers.

Completing this work will involve interviewing several members of the sales team, an historical analysis of opportunities lost and won, and using a sales engagement platform (i.e., a database of companies and contacts searchable across several dimensions) to gain a deeper understanding of the size and profile of the addressable market. When searching for C-Level, VP-Level, and Directors working at U.S. companies with more than 100 employees, a leading database like ZoomInfo includes approximately 2.66 million contacts working at about 123,000 companies.

In a recent project for a distribution company that generated about 25 new customers yearly over the last two years, using ZoomInfo, we identified about 8,000 new potential customer accounts and approximately 40,000 contacts matching the targeted persona in about two weeks' work (all contacts with at least a business email, and about 70% with a direct phone number).

2. Defining the new processes and organizational roles

Account-based outbound prospecting is the most effective way to get in front of more new prospects (i.e., potential new buyers with a good fit) to generate new sales opportunities. This frontend sales process leverages:

- External databases to identify accounts and contacts matching the ideal customer profile and persona, source company and contact information, and research other data required to craft personalized messages.

- Structured sequences of outreach activities (i.e., emails, calls, voicemails, social media messages, etc.) to ensure persistency, consistency, and outcome predictability.

- Templated messaging and other carefully crafted content (i.e., personalized email and voicemail templates, case studies, etc.) to generate high levels of curiosity, interest, and engagement.

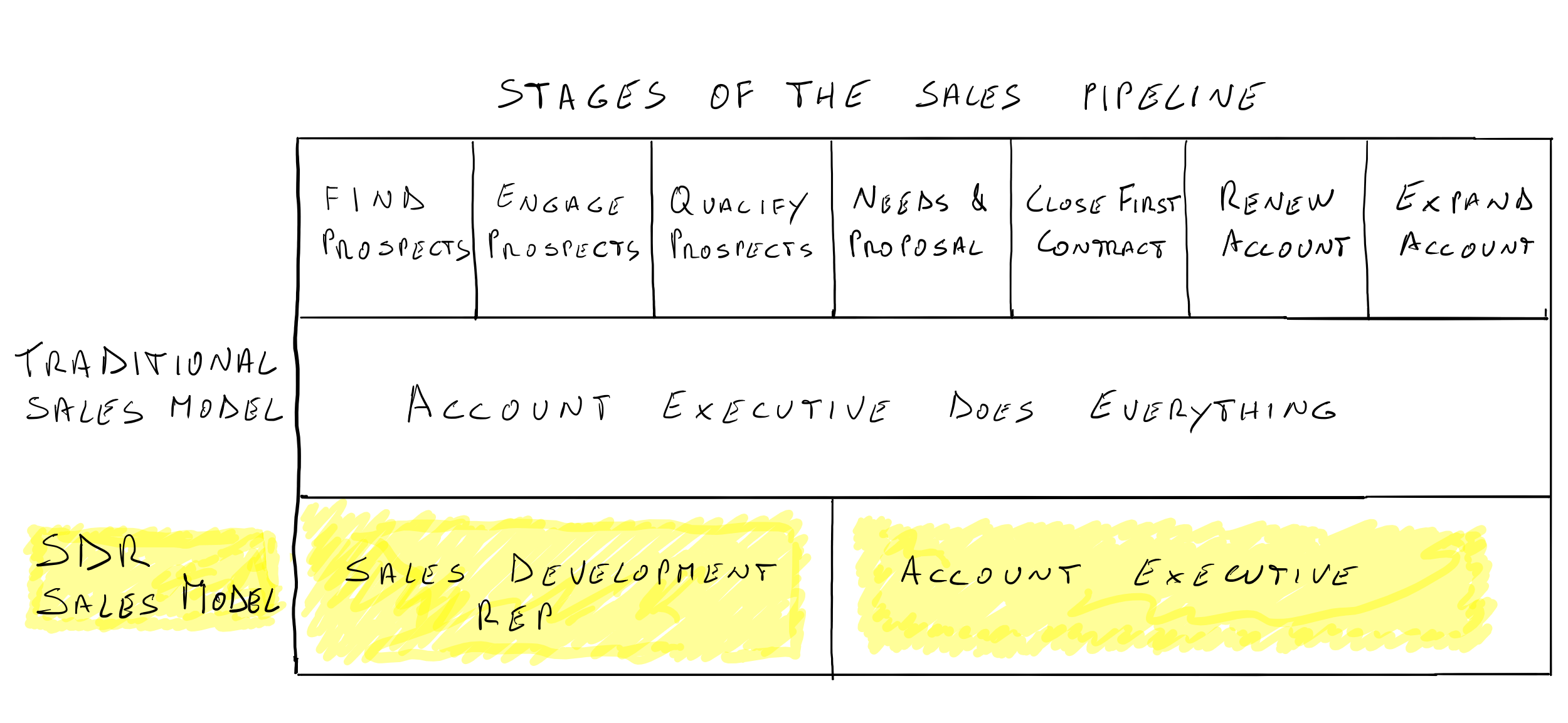

- Specialization of roles to increase productivity and cost-effectiveness, with younger Sales Development Reps focusing on outreach activities and initial discovery calls and more experienced Account Executives concentrating on managing the new sales opportunities generated by the frontend process.

- A modern sales technology stack (i.e., sales intelligence tools, workflow automation tool, CRM, sales engagement platform, etc.) to maximize consistency, productivity, cost-effectiveness, learning, and ongoing process optimization.

In a modern sales organization, Sales Development Reps (SDRs) focus on the sales process front and are responsible for researching new accounts matching the ideal customer profile, reaching out to key contacts at those accounts to generate curiosity and interest, and qualifying engaged prospects to identify those ready to take action to solve a problem. The output of their work is new sales opportunities for Account Executives (AEs).

On the other hand, AEs are responsible for turning new sales opportunities into actual sales, retaining new accounts, and growing annual revenue from existing customer accounts during their lifetime.

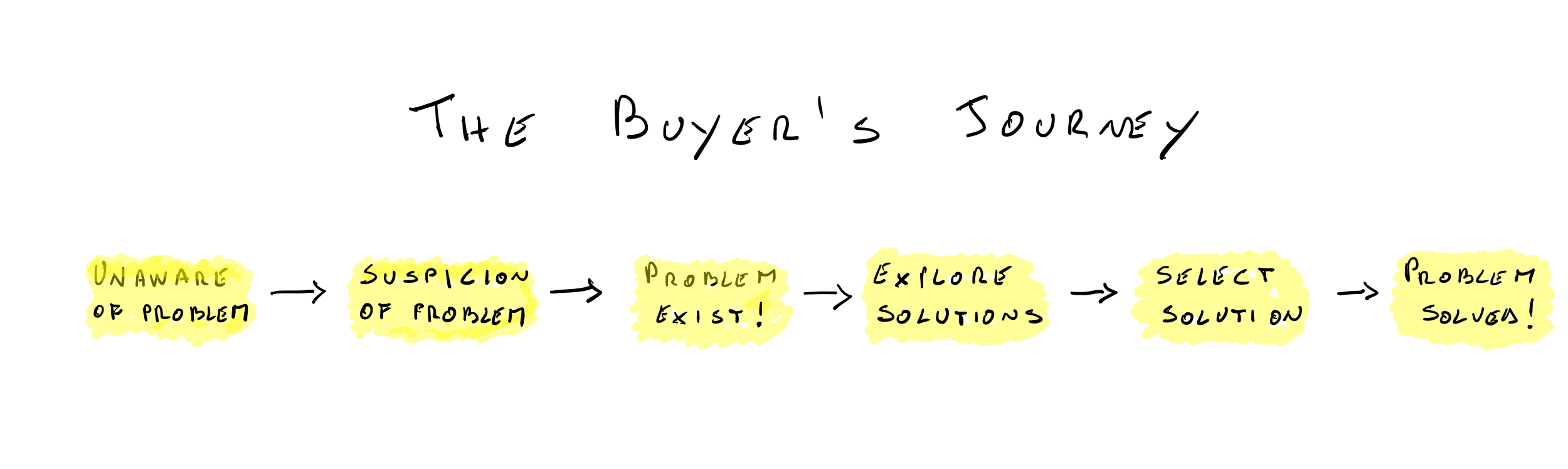

When thinking about the SDRs' job, it's helpful to reference a framework called The Buyer's Journey (the version illustrated below is from Cory Bray and Hilmon Sorey).

An SDR working on outbound prospecting might enter the buyer's journey at any of the abovementioned points. In some cases, the prospect might be already in the market proactively searching for the best solution to solve a problem. In other cases, the prospects might need to be made aware that their organization has a problem for which a good solution exists in the market.

To be successful, SDRs need to design outbound prospecting campaigns with messaging appropriate for prospects at various stages of the buyer's journey. Finally, when engaging with a prospect, they need to quickly figure out the buyer's journey stage and make the conversation relevant and helpful to that prospect.

In today's market, several options exist to outsource the SDRs' work and this is a practice adopted by several technology startups. For middle-market companies that typically operate in smaller and specialized industry verticals, however, our recommended approach is to keep this work in-house to build and protect institutional knowledge and achieve the best results.

3. Selecting and deploying the technology stack

The market for sales tools is very mature nowadays and includes many relatively affordable options addressing a wide variety of needs. For middle-market companies, we like to choose easy-to-use and maintain tools that are well-designed, have intelligent and comprehensive functionalities, and are developed by companies dedicated to excellent customer support.

Completing this work will typically take three to four weeks. When correctly done, no manual data entry activities will be required, and the solution will provide data integrity and consistent, repeatable structured processes. A section toward the end of this article will outline our recommended sales technology stack for middle-market companies in 2023.

4. Launching the first sequences

Designing, building, and deploying the first new sequences (i.e., prospecting campaigns) is the next crucial step in these projects, typically taking an additional three to four weeks. These sequences' objectives are to generate curiosity and interest among prospects by leveraging well-crafted and valuable content (i.e., case studies, testimonials, videos, etc.)

The best way to manage these sequences is to use a sales engagement platform that can easily manage multi-touch and multi-channel (i.e., email, phone, voicemails, social media channels, etc.) campaigns and provide workflow automation, reporting, and KPIs out of the box.

In our projects, the average time between the project start and the launch of the first 2-3 sequences is usually two to three months.

The two critical success factors for account-based outbound prospecting are the appropriate targeting of prospect accounts and persona and the content's quality and relevance.

5. Validating the new strategy

After the launch of the first sequences, the initial validation of the prospecting strategy will typically take between six to eight months, depending on the length and complexity of the sales process.

For companies with a good product/market fit, achieving the metrics below will indicate the program's success. The monthly number of new opportunities and new customers will depend on the volume of targeted prospects.

| KPI | TARGET METRICS |

|---|---|

| Email open rate | 60% to 80% |

| Engagement rate across channels | 3% to 6% |

| Interest rate | 40% to 60% |

| New opportunities won rate | 15% to 20% |

For a company targeting 2,000 prospects each month, a successful program should generate between 7 and 30 new opportunities and between 1 to 6 new customers monthly.

The majority of the prospects added to a sequence will be unresponsive for various reasons (i.e., not interested, too busy, no immediate need, etc.). A good outbound prospecting program, therefore, will define a prospect lifecycle management policy. Typically, our recommended approach is to re-contact unresponsive prospects every four to six months over a maximum period of two to three years.

At the end of an 8 to 10 months period, the portfolio company will have a validated strategy to accelerate B2B customer acquisition, a set of proven and repeatable sales processes enabled by modern technologies, and a well-trained and more motivated sales team. At this point, our project will conclude, and all managerial activities will transition to the internal sales leadership team.

Overcoming the internal resistance to change

Resistance to change is a natural element of business life at most companies, and the more mature a sales team is, the more resistance should typically be expected.

Therefore, to ensure the program's success, the CEO should develop an explicit change management strategy with the Board of Directors support. Proven best practices include the following:

- Articulating and communicating the benefits of the change continuously and consistently.

- Involving all stakeholders in the decision-making process.

- Selecting a small group (i.e., 2 to 4 people) within the sales team to run the pilot program for 12 months.

- Creating excitement about the new initiative and providing adequate training and support (i.e., partnering with an external professional firm to help design and execute the pilot project).

- Offering appropriate incentives for successful implementation (i.e., no changes to the standard MBO's program goals and an additional bonus for meeting the pilot program targets).

Our recommended technology stack in 2023

The market for sales tools is very mature nowadays and includes many relatively affordable options addressing a wide variety of needs. For middle-market companies, we like to choose easy-to-use and maintain tools that are well-designed, have intelligent and comprehensive functionalities, and are developed by companies dedicated to excellent customer support. For 2023, our recommended sales stack includes the following companies:

- Sale intelligence platforms (i.e., contact data sources): ZoomInfo and LinkedIn Sales Navigator are our default choice covering 90% of our typical requirements. In a few cases, like when working with healthcare companies, these databases are integrated with other industry-specific tools.

- CRM systems: more than 500 CRM systems are available in the market today, and Salesforce remains the market leader. However, while Salesforce is an excellent software application, its focus is on the requirements of large enterprises. As a result, it is often too complicated and expensive for middle-market companies to set up and maintain, given that it requires a dedicated system administrator. When working with companies that have not adopted a CRM system yet, we prefer to adopt other excellent products specifically designed for small and middle-market companies like Pipedrive and Insightly.

- Sales engagement platforms (i.e., tools to manage multi-touch and multi-channel out reach sequences): this segment also continues to see several new entrants, and for very large sales teams Outreach remains the category leader. However, for smaller teams, our preferred choices include Outplay and Klenty.

- Video platforms: as more and more companies adopt outbound prospecting in their go-to-market strategies, differentiation is becoming more and more challenging. Compelling and differentiated content generating curiosity and interest is the key driver of any successful outreach program, and embedding short videos is a proven best practice in 2023. Here our preferred tools are Vidyard and Wistia.

Pragmatic steps to move forward

With many available good ideas and the constrained execution capacity typical at middle-market portfolio companies, deciding what initiatives to include in value creation plans is crucial for private equity firms. Based on our experience, for B2B businesses with 2,000 or more potential new accounts in their addressable market, deploying a modern and structured sales process enabled by data and software technologies should be a key priority.

To build confidence about and consensus around the strategy, we recommend the following approach:

- Assess how many companies in the current portfolio would benefit from a proven playbook on accelerating B2B new customer acquisition.

- Select a champion portfolio company to validate the strategy and a suitable partner to lead a pilot project.

- Assess the pilot project's results during the initial 10 to 12 months and, if successful, scale the initiatives at all suitable portfolio companies.

Accelerating organic growth is a key driver of value creation offering a significant ROI at many companies. Increasing the volume of new business opportunities entering the sales funnel through a structured and repeatable process is the best strategy to achieve that goal.

One final question: two paragraphs in this article are a lightly edited version of an answer from ChatGPT. Can you guess which ones? Reach out here to let us know!

Augeo Partners is a boutique firm of senior leaders with a passion and significant track record in driving organic growth and operational productivity through strategy, change management, and digital technologies. We partner with private equity investors and management teams to accelerate value creation through a set of proven strategies and repeatable playbooks. The time to leverage business best practices and digital technologies to accelerate B2B new customer acquisition is now, and Augeo Partners can help.