Leveraging B2B Outbound Prospecting To Accelerate Organic Growth (Part 1 of 3)

Accelerating organic revenue growth is an important operating challenge for many B2B companies in both normal and difficult times. B2B companies with a compelling value proposition and a fragmented market demand could leverage outbound prospecting to capture an additional 8% to 12% in cumulative organic revenue growth over a 3 - 4 year period. That would typically produce an increase in the equity value of at least 20% to 35%. Sometimes the upside could be even higher. This article outlines the basics of outbound prospecting and introduces a case study from the flexible packaging industry.

Both operating partners at private equity firms and CEOs at portfolio companies agree that accelerating organic revenue growth is their #1 operating challenge.

Source: Blue Ridge Partners Private Equity Survey, May 2018

During the last three years, the flexible packaging manufacturer referred in our case study had been able to acquire only 5 new customers that during the last fiscal year generated only 1.7% of total company revenues. After setting up a new outbound prospecting process, during the first 4 weeks after launch the company was able to reach out to 571 new prospect contacts working in key positions at 103 prospect accounts and engage with 18 new executives at 11 new accounts.

What is outbound prospecting

For many B2B companies account-based outbound prospecting is the most effective way to get in front of more new prospects (i.e. potential new buyers with a good fit) in order to generate new sales opportunities. This frontend sales process leverages:

- External databases to identify accounts and contacts matching the ideal customer profile and persona, source company and contact information, and research other data required to craft properly personalized messages.

- Structured sequences of outreach activities (i.e. emails, calls, voicemails, social media messages, etc.) to ensure persistency, consistency, and outcome predictability.

- Templated messaging and other carefully crafted content (i.e. personalized email and voicemail templates, case studies, etc.) to generate high levels of curiosity, interest, and engagement.

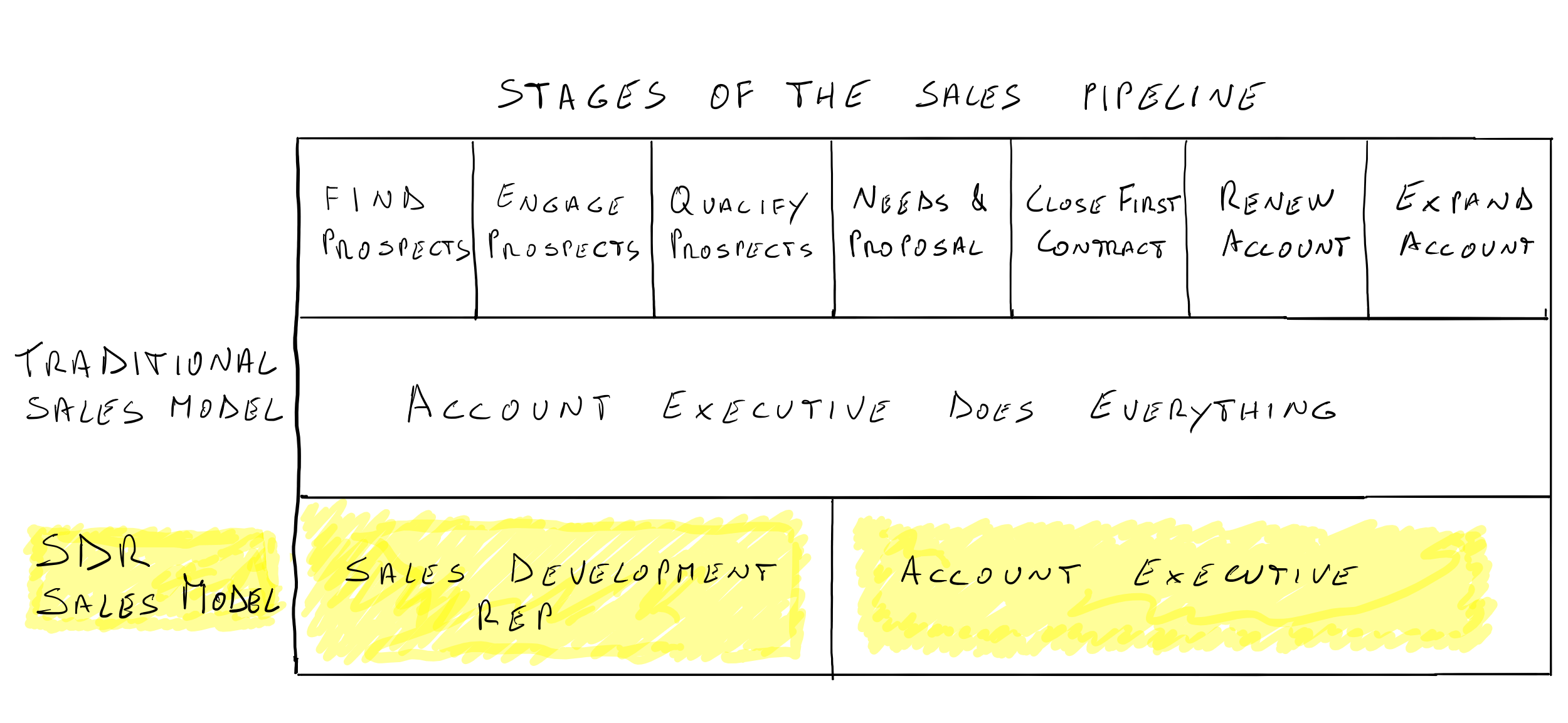

- Specialization of roles to increase productivity and cost effectiveness with younger Sales Development Reps focusing on outreach activities and initial discovery calls. More senior Account Executives instead concentrate on the new sales opportunities generated by the frontend process.

- A modern sales technology stack (i.e. sales intelligence tools, workflow automation tool, CRM, sales engagement platform, etc.) to maximize consistency, productivity, cost effectiveness, learning, and ongoing process optimization.

In modern sales organizations, Sales Development Reps focus on the frontend of the sales process and are responsible for researching new accounts matching the ideal customer profile, reaching out to key contacts fitting targeted personas at those accounts to generate curiosity and interest, and qualifying engaged accounts to identify those that are ready to take action to solve a problem. The output of this work is new sales opportunities for Account Executives.

When Account Executives accept a new sales opportunity they become responsible for converting it into an actual sale, maximizing the new customer account lifetime, and growing annual revenue from that customer account during its lifetime.

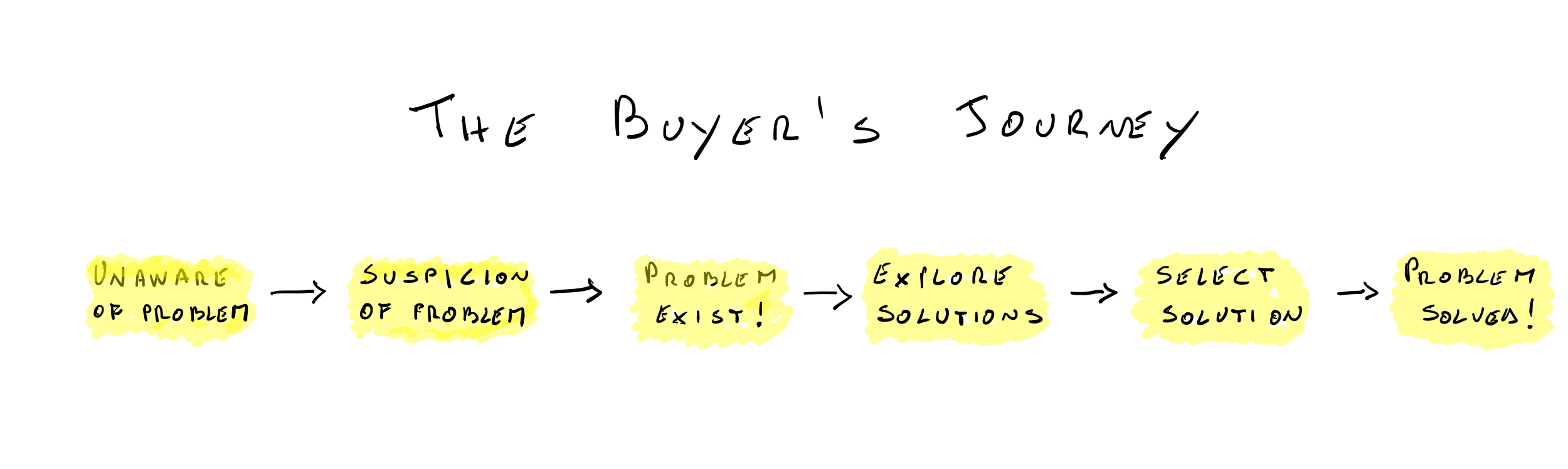

When thinking about the job of SDRs, it's useful to reference a framework called The Buyer's Journey (the version illustrated below is from Cory Bray and Hilmon Sorey).

An SDR working on outbound prospecting might enter the buyer's journey at any of the points illustrated above: in some cases the prospect might be already in the market proactively searching for the best solution to solve a problem. In other cases the prospect might not even be aware that their organization has a problem for which a good solution exist in the market.

To be successful SDRs need to design outbound prospecting campaigns including different kinds of messaging appropriate for prospects at different stages of the buyer's journey. Also, when they engage with a prospect, they need to quickly figure out where they are and how to adapt the conversation to make it relevant and helpful to that specific prospect.

Sales Development Teams are typically responsible for managing both outbound prospecting and inbound marketing leads (i.e. leads originated by marketing at trade shows, through content marketing activities, or with traditional or digital advertising). The team is usually located in either Sales or Marketing and in any case need to collaborate smoothly with both functions in order to be successful.

During the last ten years modern Sales Development processes, best practices, and technologies have been developed mostly by leading Enterprise SaaS companies pursuing very large value creation opportunities. With many companies offering equally compelling SaaS products, the quality of the sales development efforts is often the key factor seperating the winners from the rest in that industry.

A short and non exhaustive list of some of the best books discussing how leading technology companies are leveraging outbound prospecting to achieve a competitive advantage includes the following titles:

- Fanatical Prospecting - Jeb Blount and Mike Weinberg, 2015

- Predictable Prospecting - Marylou Tyler and Jeremy Donovan, 2016

- From Impossible To Inevitable - Aaron Ross and Jason Lemkin, 2016

- The Sales Development Playbook - Trish Bertuzzi, 2016

- Sales Development - Cory Bray and Hilmon Sorey, 2018

More recently, traditional B2B companies operating outside of the technology industry have also started to discover the strategic value of properly adapted Sales Development and Outbound Prospecting tools and practices.

To facilitate the discussion in this article we'll reference a disguised case study from the flexible packaging industry that in North America accounts for about 400 competing companies that are expected to generate about $45.9B in total market revenue in 2020.

This is a a good example of a relatively small industry where nevertheless developing an outbound prospecting capability is a strategic initiative that can and will generate significant value for several current and emerging leaders.

Why is outbound prospecting important

With lower unit outreach costs and very low marginal costs, modern Sales Development and Outbound Prospecting practices allow leading companies with the most compelling value propositions to reach out to and engage with from as little as a few thousands to as many as several hundred thousands prospect accounts. In many B2B industries this will drive a greater level of competitive rivalry and an acceleration in the natural process of market revenue consolidation.

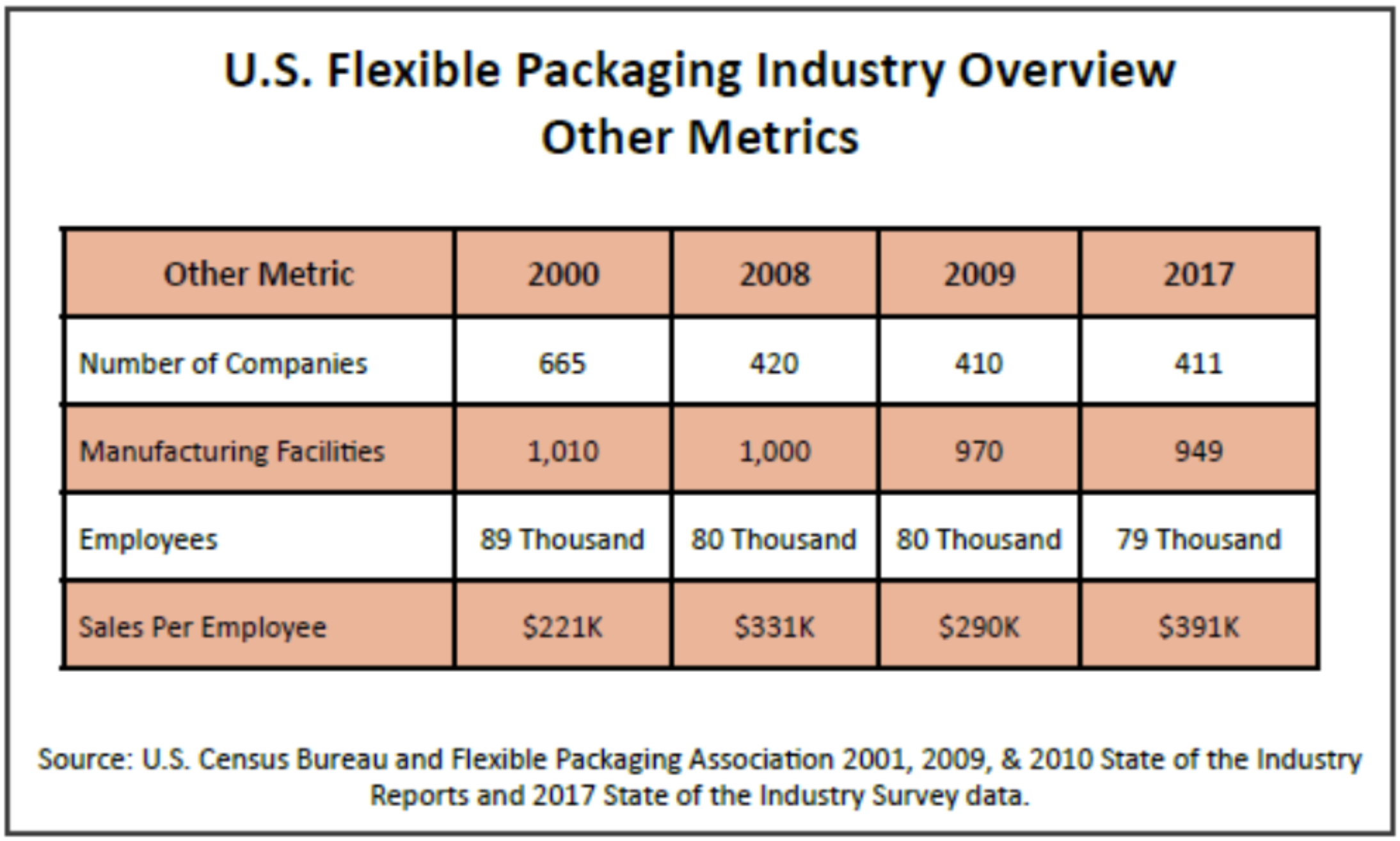

Similarly to what happened in many other B2B industries during the last twenty years, companies in the flexible packaging industry on average has been able to achieve a significant increase in productivity.

According to the Flexible Packaging Association, between the years 2000 and 2017, industry average sales per employee in the U.S. increased by 76.9% (from $221K in 2000 to $391K in 2017).

The significant increase in productivity was driven by a 56.9% increase in total market sales (from $19.7B in 2000 to $31B in 2017) and a considerable level of M&A driven industry consolidation that resulted in a 38.2% contraction in the number of companies (from 665 in 2000 to 411 in 2017), an 11.2% reduction in the industry labor force (from 89K total employees in 2000 to 79K in 2017), and a 9.4% decrease in the number of manufacturing facilities (from 1,010 in 2000 to 949 in 2017).

According to data from the Flexible Packaging Association in 2017 the Top 5 companies accounted for about 40% of industry revenues, the Top 20 for about 63%, and the Top 100 for 79%. However, in this market the battle for leadership is clearly not over yet and more market revenue consolidation is expected.

In 2018 8 companies had total revenue in excess of $1B (in some cases including revenue also from other packaging product lines), 17 companies had total revenue between $100M and $1B, and about 350+ companies had total revenue of less than $100M each (Flexible Packaging Magazine, July 2019).

As existing and emerging leaders in this industry continue to strive for greater levels of productivity and market share, an increasing number of CEOs at leading companies are trying to accelerate top line growth by combining proven M&A activities (that however are becoming more difficult and more expensive by the day) with renewed efforts to increase the organic acquisition of new accounts.

Unfortunately, in too many cases those renewed efforts are not delivering the expected results for two main reasons.

First, many companies still operate with a traditional sales model (i.e. with sales representatives responsible for both managing existing accounts and developing new accounts) that makes developing new accounts very difficult. With about 80% or more of the sales team available time usually absorbed by activities related to existing accounts, it is no surprise that at many companies organic growth is mostly driven by share of wallet increases at existing accounts and that yearly organic revenue growth from new accounts is often less than 1%.

Second, digital efforts to generate new qualified leads and sales opportunitues are limited to digital inbound marketing activities that often are not the best option to fully identify and capture available market opportunities.

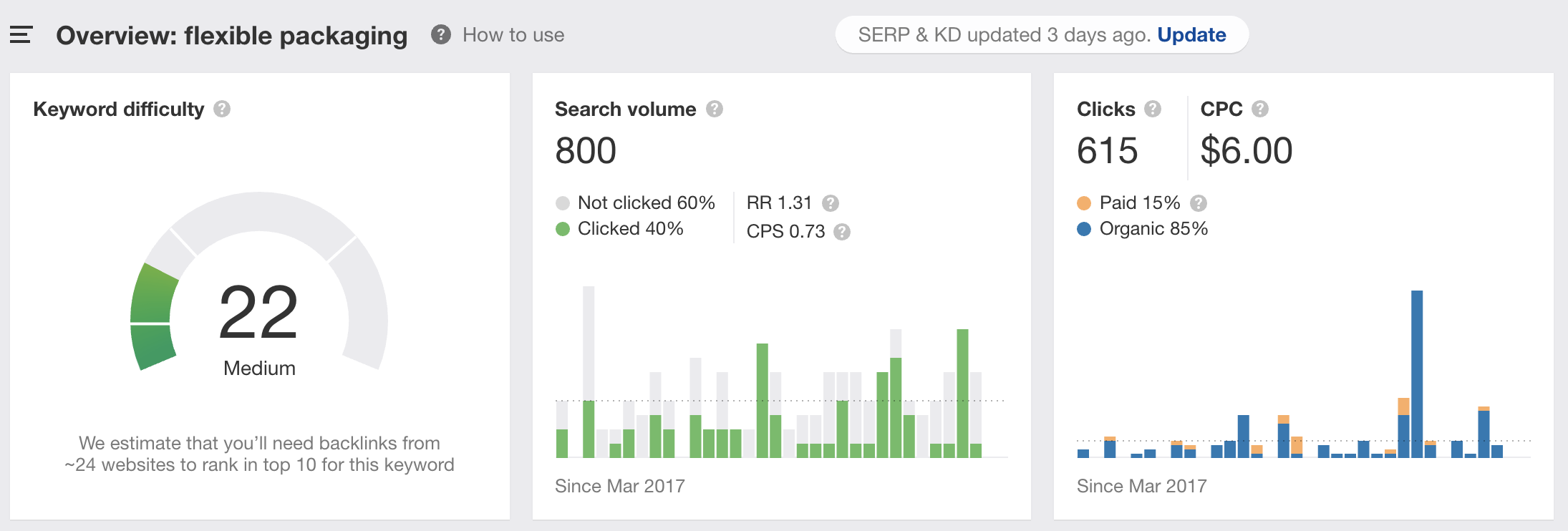

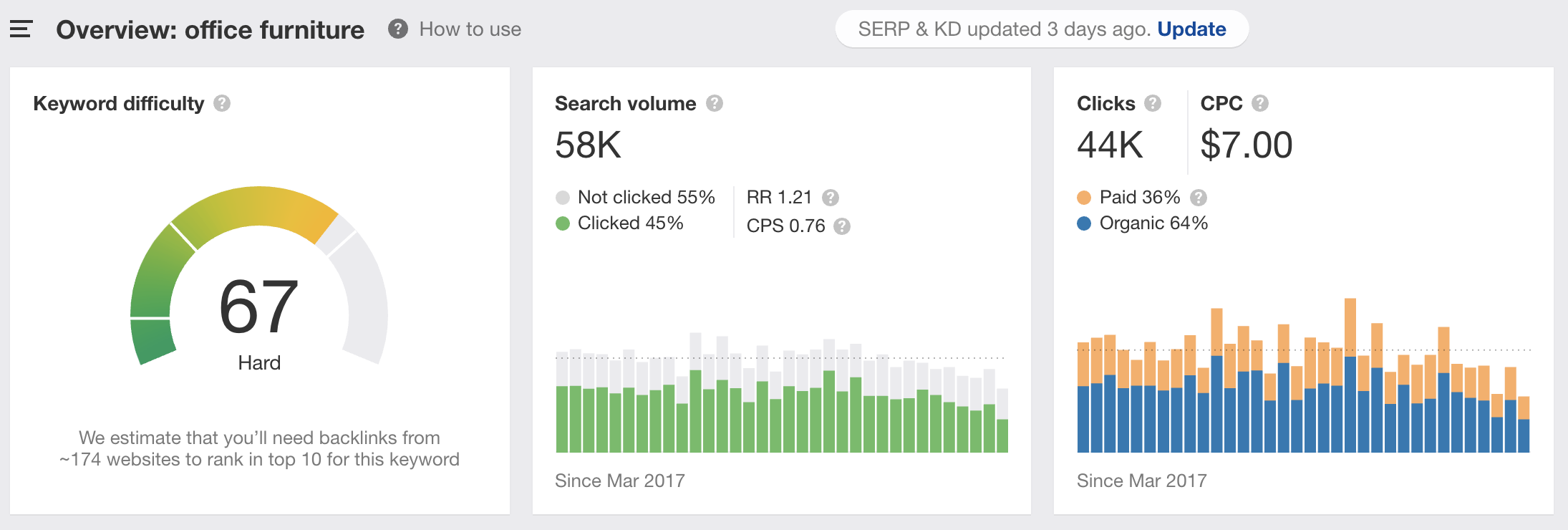

In our case, for instance, using a simple digital marketing tool to analyze internet search traffic for some topical keywords we could easily verify how average monthly internet search volumes in the flexible packaging industry are simply too low for inbound digital marketing activities to deliver meaningful results (for example, in the US the flexible packaging keyword on average is searched only an estimated 800 times each month. For comparison, the office furniture keyword is searched about 58,000 times according to estimates by Ahrefs).

In many B2B industries, using one of several available sales intelligence tools to research prospect accounts and contacts matching the ideal customer profile and persona will provide clear evidence that to generate greater volumes of new qualified leads and sales opportunities outbound prospecting is a more appropriate and scalable digital strategy.

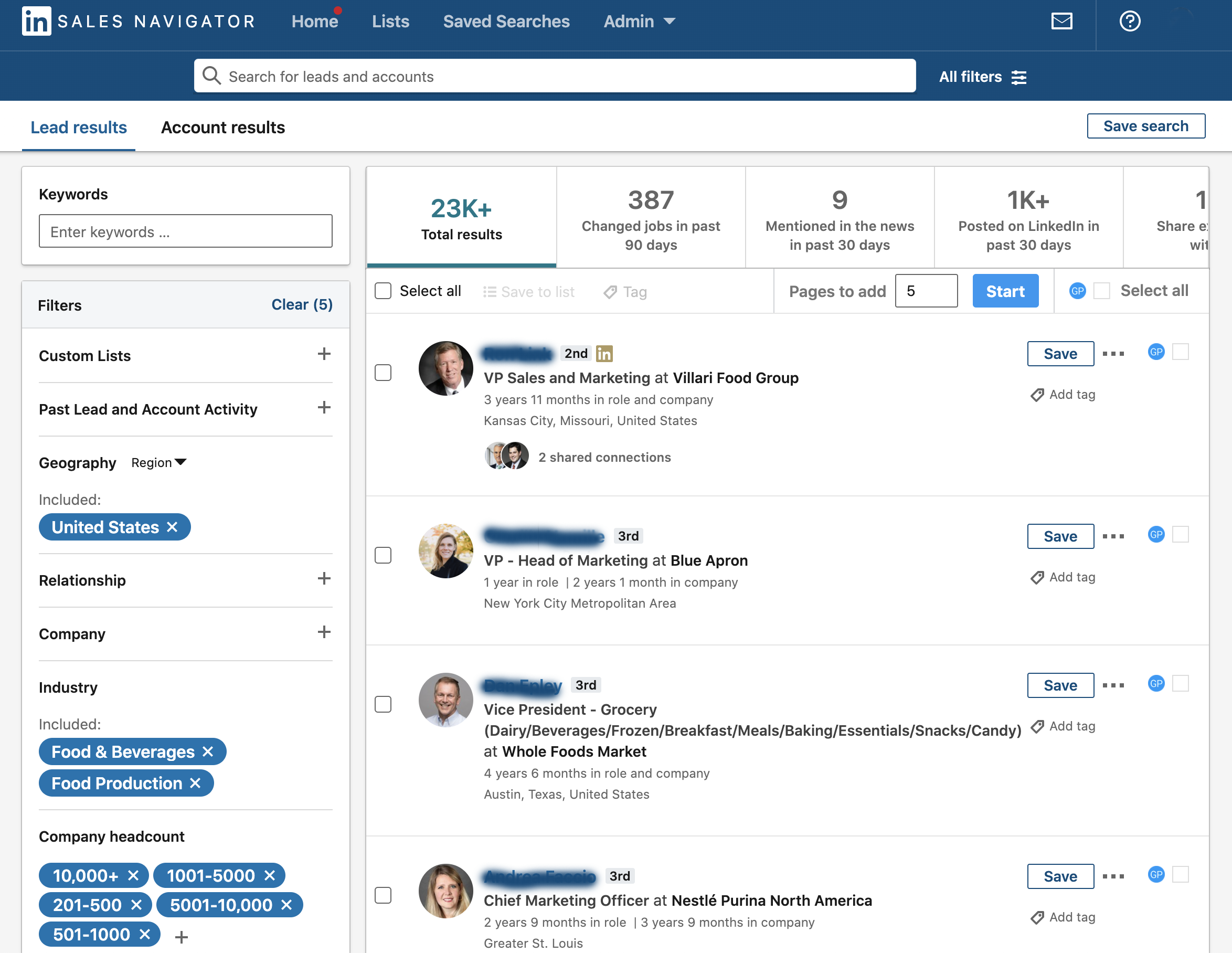

In our case, using LinkedIn Sales Navigator we could easily find out that in the Food & Beverages industries there are:

- More than 3,000 U.S. based companies with 200 or more employees;

- In excess of 23,000 prospect contacts working at those companies with either a CXO or VP title (i.e. potential buyers or influencers) in one of five key target functions (i.e. Finance, Marketing, Product Management, Procurement, and Operations).

If appropriate, with a structured and professional outbound prospecting multi-channel campaign (i.e. using email, phone/voicemail, social media messaging, video, etc.) a flexible packaging company could try to engage all targeted prospects one or more times each year in a very cost effective way.

Based on past experience and market research performed with available sales intelligence and other digital marketing tools, therefore, it's often easy to validate that when the servicable addressable market (SAM) includes from a few thousands to several hundred thousands prospect accounts building a modern data driven, structured, and highly automated account-based outbound prospecting capability is the best digital strategy to allow a leading B2B company to accelerate the organic acquisition of new accounts.

In a next article we'll discuss how to develop an investment case for outbound prospecting.