Developing A Digital Transformation Program Investment Case For B2B Companies (Part 2)

In a previous article we discussed how a digital transformation program can often help B2B companies achieve three essential goals:

- Accelerate organic growth by developing a superior ability to earn attention and engagement from existing and new customers.

- Improve customers' loyalty by helping them achieve higher levels of internal productivity.

- Increase the level of internal productivity across several operational processes.

Here we develop the investment case and first year budget for the program outlined in that previous article.

Developing a program investment case and first year budget

With the program objectives and action plan properly articulated, the next and final step is to develop the digital transformation program investment case and first year budget. Like for any business investment decision, this will require an estimate of certain key assumptions and an assessment of potential risks and rewards.

The process is typically articulated in the following three phases:

- Understand the buyout base case (without digital transformation program) and the available market opportunity.

- Develop the digital transformation program investment case and first year detail plan and budget.

- Assess the program prospective risks and rewards and identify possible mitigation actions.

To facilitate the discussion we will refer to a case study for a middle market B2B company with about $400M in revenues in a pre COVID-19 situation.

Phase 1: Understanding the buyout base case (without digital transformation)

Objective of the first phase is to understand the company's historical and projected performance, the company current competitive positioning, and the strategy to be implement to earn a greater level of attention and engagement among existing and potential new customers. This is accomplished by:

- Analyzing historical and projected financial data with a particular focus on key sales metrics by customer segment (i.e. average annual sales, attrition, average length of selling cycle, new opportunity closing rate for existing and new customers, gross margin by product category, etc.).

- Completing a company SWOT analysis.

- Developing an estimate of the available addressable market and its key characteristics (i.e. estimated annual sales volume, profile of target customers, KBFs, main competitors currently used, etc.).

The output of this phase is a set of financial information that are required to build the program investment case, a profile of the targeted new customers, and guidelines regarding the offering and communication strategy to be implemented to gain greater customers' attention and engagement.

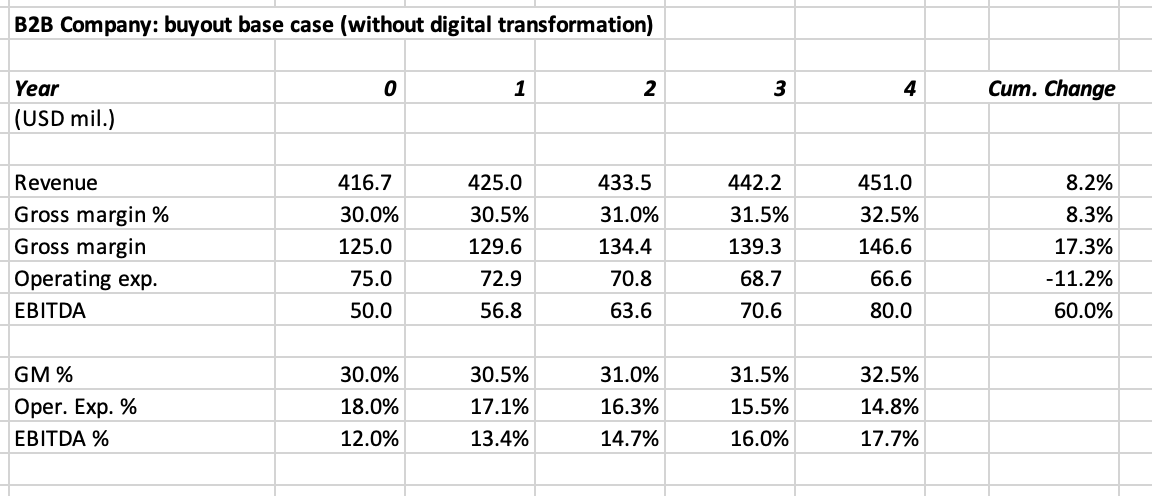

Following is a simple base case P&L statement that we'll be referring to as we develop the investment case. The year before the launch of the digital transformation program is referred to as Year 0. The financial information might refer to projections for a single company or, in case of planned add-on acquisitions, preliminary consolidated projections for the combined entities.

The projections reflect the case of a well performing company with an expected average annual organic revenue growth rate of 2%, a good expansion in the gross margin driven by a number of planned initiatives (i.e. pricing, procurement, manufacturing rationalization, etc.), and an increasing level of operating efficiency.

Source: Augeo Partners

Phase 2: Developing the digital transformation financial projections

The program investment case and first year budget are developed through an iterative process using top down targets and a bottom up marketing and sales model used to validate the program targets and estimate the resources required to implement the program. The process is articulated in the following five steps.

Step 1: Set target EBITDA increase by source

Based on the estimated size of the available addressable market and an assessment of the company's value proposition relative strength, an initial target EBITDA increase relative to the base case is defined. This will typically range between 10% to 20%. In this case we set a target of 15% or $12M in incremental EBITDA generated in Year 4 given the projected base case. The next step is to decomposed this amount between the amount generated by additional operational expense savings (in our case optimization of IT spending and intelligent process automation of after sales processes) and the amount to be obtained from additional organic revenue. Since we estimated that operational cost savings could generate $1.8M in incremental EBITDA in Year 4, we have a residual target of $10.2M in incremental EBITDA in Year 4 to be generated by organic revenue growth.

Step 2: Estimate revenue target for Year 4

The next step is to determine what amount of revenue will be required in Year 4 to generate $10.2M in incremental EBITDA. To answer that question the team will analyze the expected gross margin, estimate the sales and marketing expenses required to generate one dollar of incremental revenue, and calculate other sales related variable costs. In our case it was estimated that ¢13.5 in expenses would be required to generate one dollar of incremental revenue and that therefore, given an expected gross margin of 32.5%, $0.19 in incremental EBITDA could be generated for every $1 of incremental revenue. With that estimate at hand, a target of $53.7M in incremental organic revenue in Year 4 was set to generate $10.2M in incremental EBITDA.

Step 3: Develop a bottom up sales and marketing plan for Year 1 to Year 4

As any athlete knows very well, winning a race requires competitive capabilities but also a specific training plan that will allow the athlete to be in peak form the day of the race. Our race was defined as generating $53.7M in incremental organic revenue in Year 4. Next we needed to develop a specific training plan (i.e. a bottom up sales and marketing plan).

The best approach to do this is to start with the number of customers required to generate a certain amount of revenue (based on estimated average annual sales per customer) and from there to derive the number of new sales opportunities needed in the sales pipeline to generate a required number of new customers (based on estimated new opportunity closing rate and estimated length of the selling cycle), and the number of new qualified leads required at any given point in time to generate the required number of opportunities in the sales pipeline (based on estimated convertion rate of qualified leads into new opportunities and average length of the leads nurturing period). Taking into account the initial validation phase, budget constrains (i.e. limited negative impact on free-cash flow in Year 2), and other assumptions like the expected customers attrition rate, the bottom up sales model will define specific annual targets for new leads, new sales opportunities, new customers and total revenue from Year 1 to Year 4.

The final task in this step is to estimate the spending required in each period to generate the required number of new qualified leads, nurture the qualified leads in the marketing funnel, and manage the new sales opportunities in the sales pipeline.

Step 4: Develop final estimates for program total spending and incremental EBITDA

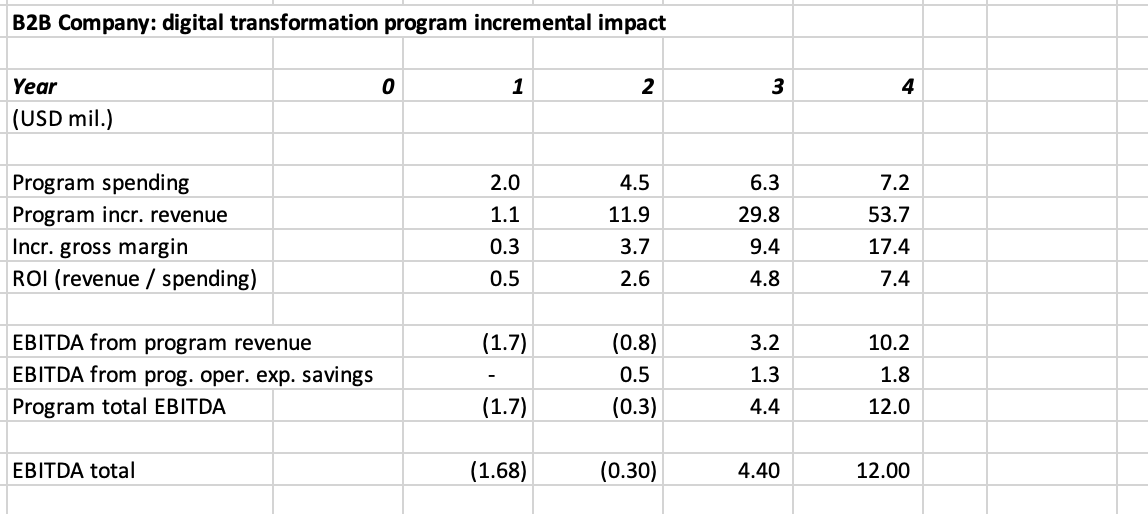

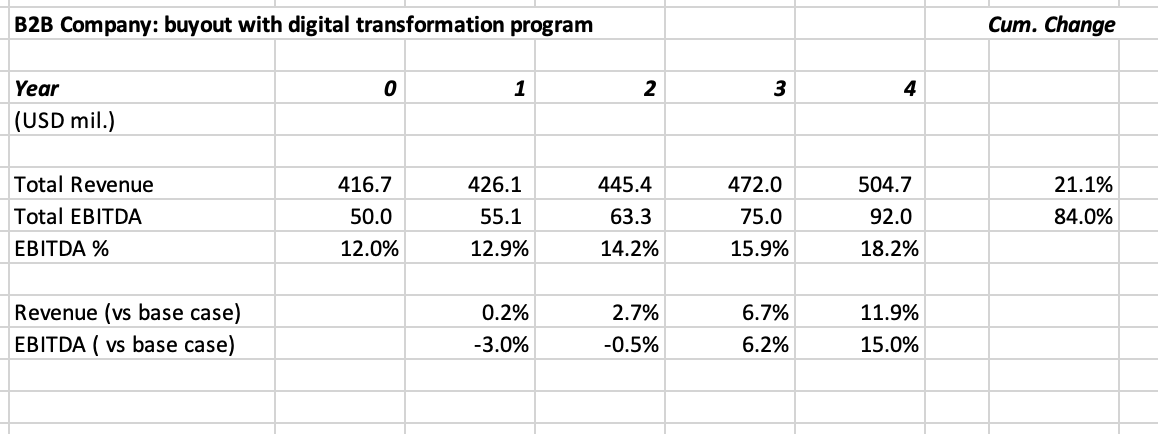

Combining all prior estimates, the digital transformation program investment base case will be elaborated as illustrated in the tables below (to simplify we assumed that all technology investments will be expensed).

Source: Augeo Partners

In this case, the Year 1 total budget was set at about $2M. In general, depending on the size of the company and the scope and complexity of the program, the Year 1 total budget will usually range between $1.5M and $4M.

Source: Augeo Partners

What is important to emphasize at this stage is that bottom up sales model will define not only the summary financial targets but also all the annual sales and marketing target KPIs (the underlying assumptions). Combined with an appropriate reporting system the model will allow the digital team to track the program performance on a monthly basis and to constantly adjust initiatives and campaigns to achieve the planned targets.

Step 5: Develop Year 1 detailed activity plan and allocate available budget

The final step is to define the detailed sales and marketing plan required to meet Year 1 goals and allocate the available budget to fund all the planned activities in the first year of operation. This will require decisions regarding which channels to use for the leads generation campaigns (i.e. email prospecting, search, and social media), the content to be developed for the marketing channels and the company website (i.e. blog articles, case studies, video testimonials, etc.), the best data vendors to be used to build a database of prospect emails, the vendor to be used to enrich the new leads data, the marketing & sales SaaS tools to be used, the developers to engage to build or re-factor the e-commerce website, etc.

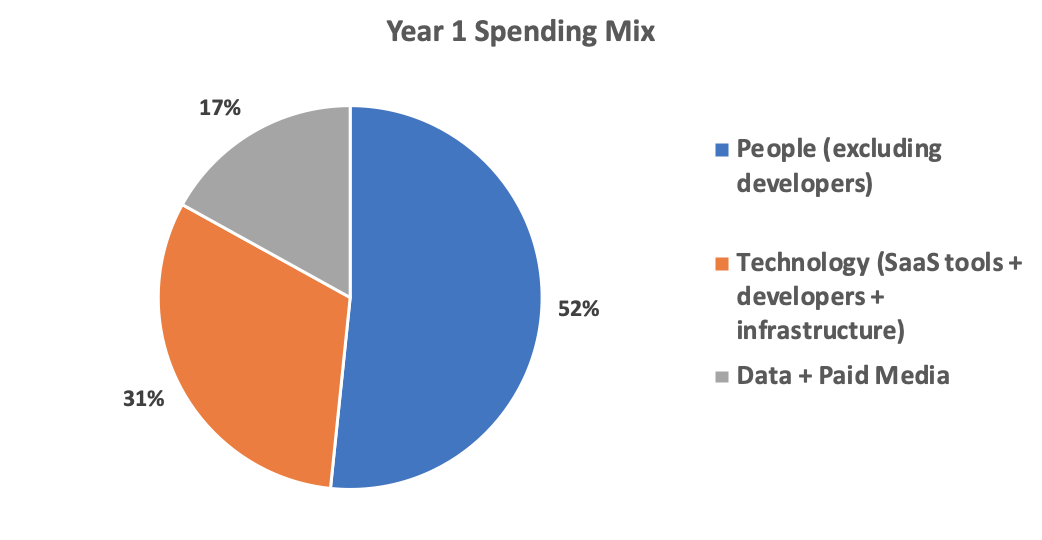

To achieve the best results the digital transformation program team in year one will include some people from inside the company allocating part of their time to the digital program, a small team of external specialized professionals, and the interim digital transformation officer. The people budget includes only the cash expenses for the digital officer and the external specialized professionals. While any generalization is always difficult, in many cases the Year 1 spending mix will approximately looks like the chart below.

Source: Augeo Partners

Phase 3: Assess risk and rewards and define mitigating actions

The final phase in the development of the investment case is aimed at assessing alternative scenarios starting from the worst case. In the worst case, after the initial 12 to 15 months the company will realize that accelerating organic revenue growth is proving significantly more challenging than originally anticipated. The program original sales & marketing spending ramp up will be curtailed, the order taking website and self-service customer portal will be completed, the key decisions regarding IT spending optimization will be defined, and the partnership with the interim digital transformation officer will come to a conclusion after an initial period of 18 to 24 months.

In the worst case, the company will not be able to achieve the targeted increase in revenue and EBITDA but the digital program will not have a negative impact on the company's net financial position as the initial investments will be compensated by some operational cost savings and minor increases in revenue.

When the program will develop as planned, the company will achieve the targeted increase in EBITDA (i.e. in our case 15%) and this will have a great positive impact on its equity value. Depending on the company financial structure and market conditions, a 15% increase in EBITDA will most likely increase the company equity value by 30% to 40%. Obviously, any case in between will still be very beneficial for all stakeholders.

Moving forward

Digital transformation is a very popular topic nowadays. Unfortunately, digital transformation is not a magic wand and sometime there are other priorities or strategies that a B2B company should focus on before embarking on a digital journey. When appropriate, however, the business case for a bold digital transformation program is very compelling with a significant positive impact on a company's equity value when successful and no meaningful risk of negative impact on its net financial position even in the worst case.

A DIY strategy in most cases will not prove to be the best choice and a senior executive team will be significantly better off by partnering with an interim digital transformation officer on the basis of a clear and pragmatic plan, the allocation of an adeguate initial budget, and a well aligned performance-based incentive system. As in every journey, the first step is always the hardest.